cTrader vs. MetaTrader

In the fast-paced world of forex trading, having access to a reliable and efficient trading platform is paramount to your trading success. Among the titans of the forex trading platform world, two names stand out: cTrader and MetaTrader 4/5 (MT4 and MT5). These platforms have amassed an extensive user base and earned their loyal followings.

In this article, we'll delve into the intricacies of each platform, comparing their features, advantages, and limitations, to help you determine which platform is right for you.

Contents

Genesis

User Interface and Customisation

Charting and Technical Analysis

Order Types and Placement

Algorithmic Trading and Expert Advisors

Mobile Trading

The Genesis of cTrader and MetaTrader

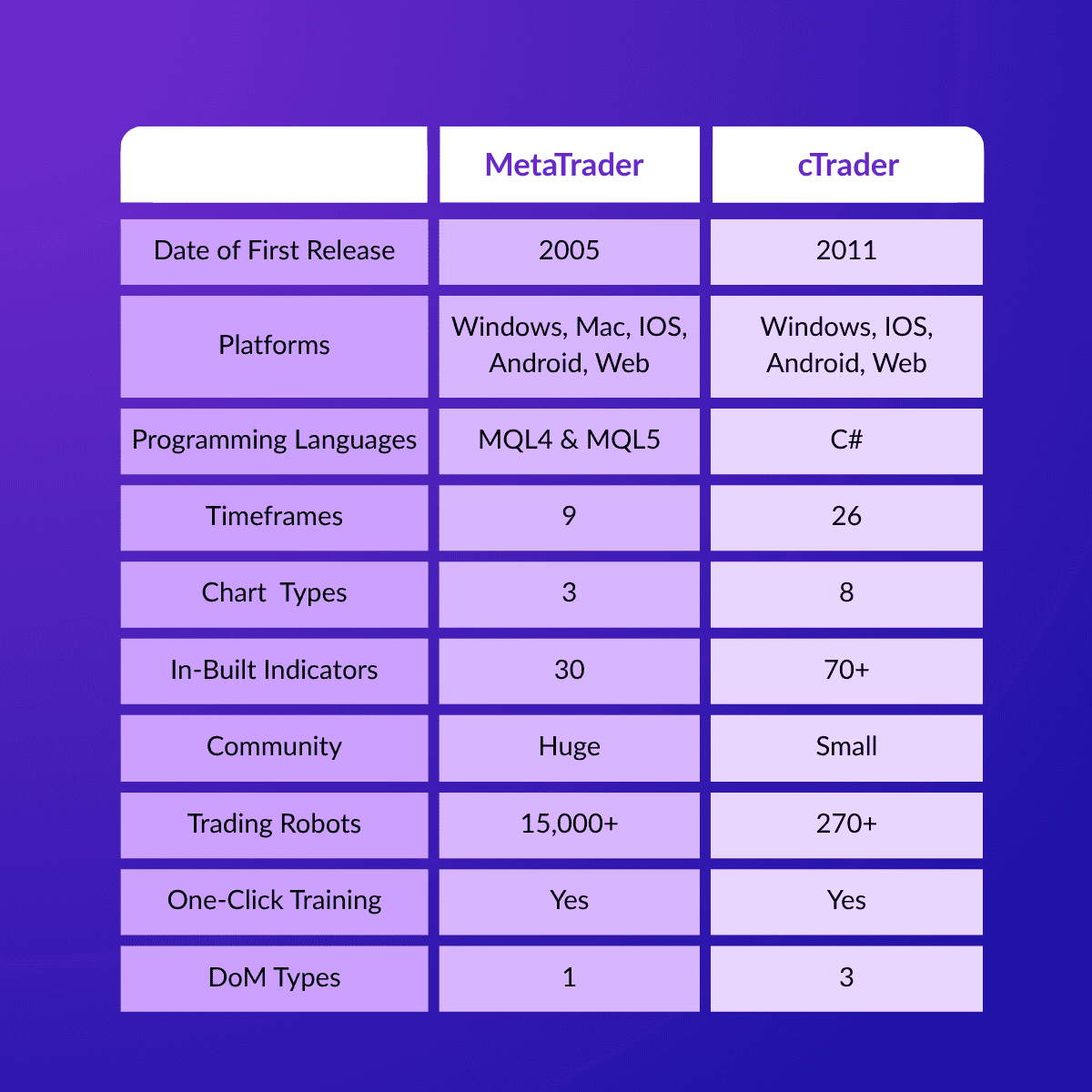

MetaTrader is the brainchild of MetaQuotes Software. The company introduced the first version, MetaTrader 4 (MT4), in 2005. Its successor, MetaTrader 5 (MT5), followed in 2010, bringing a host of new features and capabilities to the table.

cTrader was launched by Spotware Systems Ltd. in 2011, aiming to provide traders with a platform that offers a user-friendly interface and advanced functionalities. cTrader's main focus is on creating a seamless trading experience for both beginner and experienced traders alike.

User Interface and Customisation

One of the most significant factors in a trading platform's popularity is its user interface (UI). Despite MT4 being somewhat outdated compared to cTrader's modern design, both offer clean and intuitive interfaces, making them relatively easy for traders to navigate. However, they have different approaches when it comes to customisation.

cTrader takes the lead in UI customisation, allowing traders to personalise their workspace extensively. Users can arrange and resize various windows, add or remove trading indicators, and set up multiple charts on a single screen. This level of flexibility empowers traders to create an environment tailored to their specific trading needs.

On the other hand, MetaTrader, especially MT4, has a more rigid UI, with limited customisation options. While MT5 improved in this aspect, it still lags behind cTrader's superior customisation features.

Charting and Technical Analysis

In terms of charting and technical analysis, both platforms deliver robust solutions. Traders can access a wide range of chart types, timeframes, and drawing tools on both cTrader and MetaTrader.

Trader stands out with its intuitive charting package, providing more than 70 pre-installed indicators and a smooth drawing experience. It also offers Level II pricing data with its 3 depth of market (DoM) types (Standard, Price, VWAP), giving traders a greater insight into market depth and liquidity.

MetaTrader, however, remains a popular choice for technical analysis enthusiasts, thanks to its massive library of third-party indicators and analytical tools. This vibrant community-driven ecosystem ensures that traders have access to an extensive arsenal of tools to refine their strategies.

Let's dive into the specifics:

MetaTrader 4

Chart Types: MetaTrader 4 supports three fundamental chart types, namely Bar, Line, and Candlestick.

Timeframes: Nine distinct timeframes, spanning from 1 minute to 1 month.

Analytical Objects: 24 analytical objects, including lines, channels, shapes, arrows, and essential Gann and Fibonacci tools.

Technical Indicators: 30 built-in technical indicators. Furthermore, traders can explore over 2,000 free custom indicators and access 700 premium indicators available in the Code Base.

Chart Views: The platform allows traders to open an unlimited number of charts simultaneously. Moreover, traders can personalize their charts by creating templates that define specific attributes such as color schemes, chart types, scales, line studies, and applied indicators.

cTrader

Chart Types: cTrader comes with 8 chart types, but also includes additional variations such as tick and pip charts. These chart types include Bar, Line, Candlestick, Heikin-Ashi, HLC, Dot, Tick (configurable with 27 settings), Renko (with 19 settings), and Range-based charts (with 22 settings).

Timeframes: cTrader features 26 timeframes with the standard chart and over 50 timeframes and six zoom levels across all chart types (including tick and pip charts).

Analytical Objects: The platform boasts 33 analytical objects.

Technical Indicators: cTrader offers 70 built-in technical indicators.

Chart Views: cTrader introduces Chart Views, allowing traders to detach charts and use them as separate tradable desktop applications across multiple screens. Additionally, ChartShot enables traders to share trading examples and strategies relatively easily.

Order Types and Placement

Now that we've got a comprehensive view of the differences in charting, let's delve into the nuances of order placement in MetaTrader and cTrader, highlighting their distinct approaches and functionalities:

Order Placement in cTrader

- Weekend Order Placement: Traders using cTrader have the unique advantage of placing waiting orders during weekends, even when the markets are closed. This feature facilitates meticulous planning and analysis, allowing traders to prepare for the trading week ahead.

- Specialized Order Types: cTrader goes a step further by introducing specialized order types like Buy or Sell Limit, adding an additional layer of risk management and trading versatility to the platform.

- Click-and-Drag: Waiting orders, such as Buy Limit or Sell Stop, can be placed by selecting the order type and adjusting its position through an intuitive click-and-drag action directly on the chart.

- Specialised Stop-Out features: Smart Stop-Out (partial closure while retaining entry) and Fair Stop-Out (full closure to maximize margin for active positions) give traders better risk management tools.

Order Placement in MetaTrader

- Traditional Approach: MetaTrader employs traditional methods for order placement, necessitating traders to click directly on the desired spot in the chart to execute waiting orders.

- Limited Specialized Order Types: MetaTrader has all the necessary order types needed for trading but lacks some of the more advanced features like cTrader's smart stop out.

Algorithmic Trading and Expert Advisors

The next significant aspect we need to consider is automated trading. In MetaTrader applications, both MT4 and MT5, traders can utilise Expert Advisors (EAs), which are manually coded programs designed for automated tasks, such as technical analysis of price data and executing positions on specific instruments.

When comparing MT4 to MT5, the primary difference between their Expert Advisors lies in the programming language they employ. Since MQL4 has been in use for a longer time than MQL5, there is a more extensive collection of pre-written scripts and codes available for traders to create their personal Expert Advisors, even if they lack programming knowledge. On the other hand, MQL5 is a simpler programming language, making it easier for traders to create new scripts themselves.

Regarding cTrader, it also offers similar programs known as cBots, which function similarly to Expert Advisors. As mentioned earlier, cTrader uses the widely recognised C# programming language, theoretically making it the most versatile among the three languages (MQL4, MQL5, and C#) with a larger consumer base.

However, in reality, cBots are less popular than Expert Advisors (EAs), and the reason for this is that the online trading community supporting EAs is much larger than that of cBots. Consequently, there are more pre-existing templates available for MT4/MT5 compared to cTrader.

Mobile Trading

Mobile trading has become an integral part of the modern trading experience. Both platforms offer mobile applications for iOS and Android devices, enabling traders to stay connected to the markets on the go.

cTrader's mobile app is widely acclaimed for its user-friendly design and seamless functionality. It provides real-time quotes, interactive charts, and order execution capabilities, giving traders full control over their portfolios from the palm of their hand.

MetaTrader's mobile app, too, is highly regarded and offers a range of features for on-the-go trading. It allows traders to access their accounts, execute trades, and monitor markets in real time.

Conclusion

In conclusion, both cTrader and MetaTrader are powerful trading platforms, each with its own set of unique features and strengths. cTrader shines in its user-friendly interface, extensive customisation options, and array of features. On the other hand, MetaTrader's widespread popularity gives traders a great pool of resources to draw on and stronger community support, while having all the tools needed to be successful in the markets.

Ultimately, the choice between cTrader and MetaTrader depends on individual preferences, trading styles, and specific needs. Traders should consider their asset preferences, technical analysis requirements, and whether they prefer a larger community-driven ecosystem or a more user-friendly interface with more features. Regardless of the choice, both platforms have significantly contributed to enhancing the trading experience for millions of traders worldwide.

Ready to Start Trading?

- Sign Up for Fusion Markets, Australia's Lowest Cost Forex Provider*

- Create Your cTrader or MetaTrader 4 or 5 Account.

- Download Your Preferred Version of cTrader (Desktop, Mobile - iOS and Android), MetaTrader 4 (Desktop, Mobile - iOS and Android) or MetaTrader 5.

Or

Trade With Your Browser with cTrader WebTrader, MetaTrader 4 WebTrader or MetaTrader 5 WebTrader. - Fund Your Account

- Start Trading!

We’ll never share your email with third-parties. Opt-out anytime.