Getting Sentimental

We believe that wherever possible, we should remove emotions from our trading psychology and try to act logically and systematically when making trading decisions. That’s because there are facets of our emotional selves that are just no good when it comes to making money. Impulses that encourage us to snatch at profits, make rash trades and run losses can be detrimental to our wealth in the same way that running out into a stream of moving traffic could be very detrimental to our health. We could go so far as to say that there is no room for sentiment at all in trading, but if we said that we wouldn’t be entirely correct. Because while it’s true that we want to remove sentiment and emotion from our own trading, we should be quite happy to take advantage of other people’s sentiments.

Picking the right wave

Trading is effectively a three-way competition. First, you compete with yourself and your psyche, of course, you also compete with the market in the same way that a surfer competes with the ocean. That is reading the changes in the swell and the wind in order to pick to the right waves. However, you are also competing with other traders, because in forex for every winner there is a loser, and to make money, you need to try to ensure that other traders and not you are on the losing side, more often than not. To succeed, we need to follow a rules-based trading strategy that helps us back only the best trading opportunities that the market presents to us. We also need to try and develop an edge over our competition, that is other traders.

Of course, we don’t and can’t know who these other traders are, and even if we did it wouldn’t do us much good, because there are millions of them spread out across the globe trading away at any one time. However, the fact that there are so many competitors out there can work in our favour. Why? Because a crowd that big leaves a trail that we can follow and that can provide us with an edge.

Tracking the markets thinking

One of the methods that we can use to gauge what the rest of the market is thinking and doing is to look at what they are buying, selling and saying. That is measuring the sentiment towards the markets, and doing that in aggregate.

There are several ways in which we can do this. For example, we could study the weekly Commitment of Traders reports that are produced by the US CFTC which track changes in positioning in listed futures contracts (including FX majors) among key investor and trading groups. However, these reports are released three days in arrears, late on Friday afternoon in the USA. What’s more, they are not exactly user friendly in terms of their layout or the way that the data is presented or in the ease of interpretation (the CFTC is not known for its beautiful charts!).

Perhaps a more simplistic way to track trader sentiment is to look at what’s happening to the prices of safe-haven assets such as gold, the Japanese yen and Swiss franc and government bonds. If these instruments are rising in price, then that’s a sign of Risk-Off sentiment among traders.

If those safe-haven assets are strengthening when risk assets such as equities and Emerging Market currencies like the South African rand, Brazilian real and Turkish lira etc. are weakening, then you will know it’s risk-off. Of course, if we see risk assets appreciating while safe-havens are falling in price, that’s an indicator of Risk-On sentiment among market participants.

However, there are quite a few items to monitor the strategy outlined above. Since we are trying to gauge the aggregate sentiment of the crowd, it would be good if we had an indicator to gauge sentiment across a wide range of assets as well.

True we could try to use the VIX and other volatility indices, volatility is a measure of the rate and severity of price changes within an instrument or market. It tends to rise sharply as markets become fearful and trend lower when fear subsides and greed re-asserts itself. But once again, this would mean monitoring multiple items from different sources, to which we may have varying degrees of access.

A single gauge of sentiment?

Instead, what if we had one indicator that could tell us what others in the markets were thinking?

Fusion Markets has partnered up with some very talented engineers to simplify this even further.

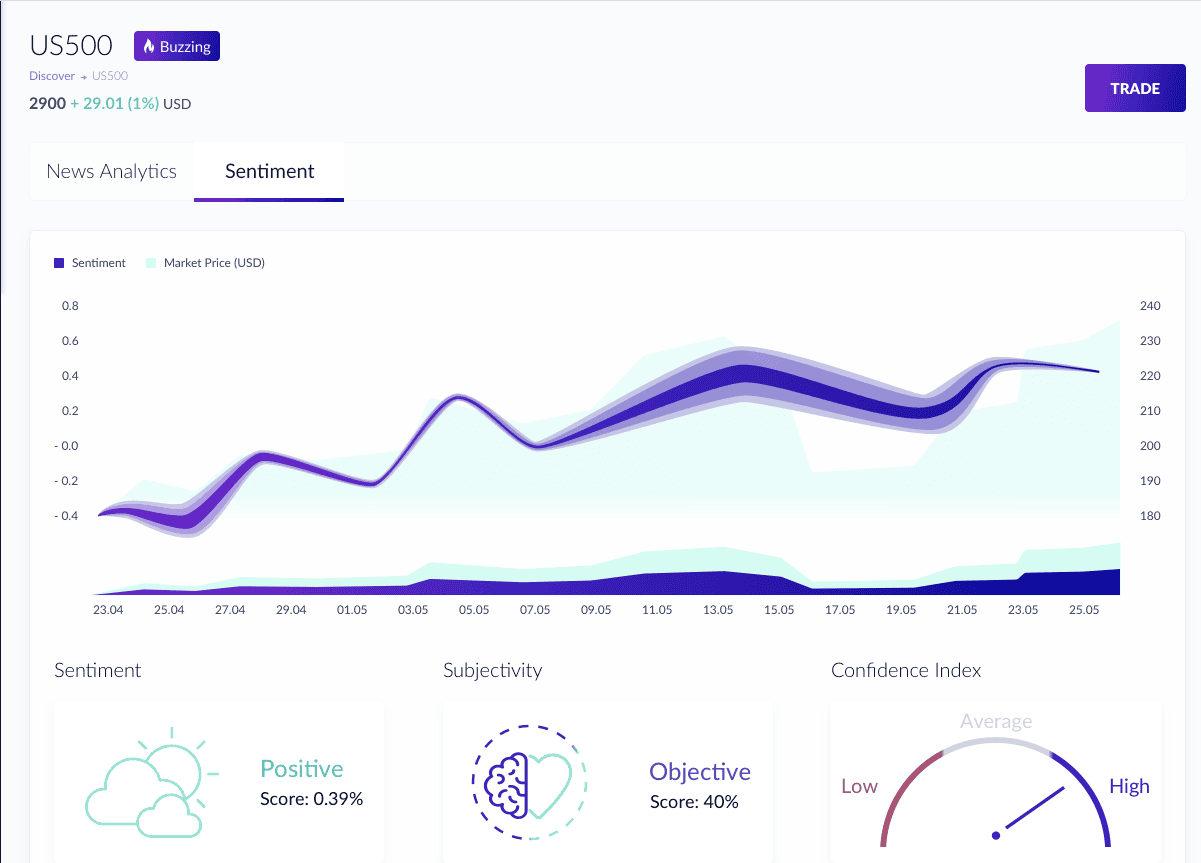

Using cutting-edge artificial intelligence techniques known as Natural Language Processing (NLP), we can use machines to take in hundreds of thousands of data points across the web to gauge sentiment.

Are people talking about the Aussie dollar? What are they saying exactly? Are they positive or negative?

What about Gold? Is the crowd bullish or bearish?

To do this, yourself (e.g. scour hundreds of thousands of sources across the web) would be impossible. That’s why we always say there’s never been a more exciting time to be a trader (at least with Fusion anyway) and have these tools available that were previously only available to the world’s best hedge funds and asset managers.

We’ll leave it to you as to whether or not the crowd thinking it is highly bullish is a good signal to trade or a bad one and the strategy here (if you’ve read our views previously, you will know the answer!). Still, while it is not the holy grail as a single strategy, we believe this is a handy weapon to add to your arsenal to get an edge over others.

To start using our Sentiment tool now, create a Fusion account (it's free and there's no obligation to trade).

We’ll never share your email with third-parties. Opt-out anytime.