What’s been driving the rally and why traders keep paying attention

Gold’s Big Year:

What’s been driving the rally and why traders keep paying attention

Read Time: 3-4 minutes

If you weren’t actively watching gold over the past year, it would’ve been easy to miss just how strong the move has been. Most of the attention has gone to equities, rate decisions, and currency volatility. Meanwhile, gold has quietly done what it tends to do best in uncertain environments – move higher, steadily, and with very little drama until suddenly everyone notices.

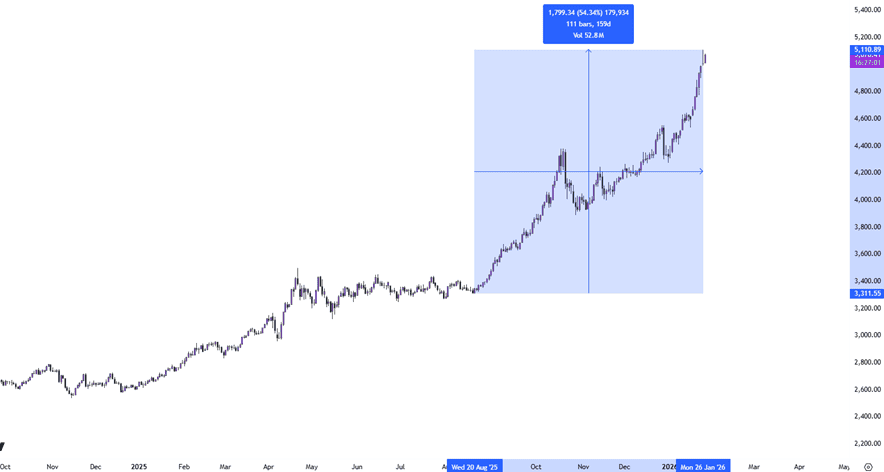

Since August 2025, gold has climbed roughly 54%, with recent highs printing near 5,110.89 against the US dollar (Figure 1). For a market as deep and liquid as gold, that’s not a small move. It’s the kind of performance that usually signals something structural is happening rather than just a short-term speculative spike.

Figure 1 – Gold’s 54% appreciation since August 2025

What’s interesting is that there hasn’t been a single “moment” that explains the rally. No one headline. No single crisis. Instead, it’s been more of a slow build. A combination of uncertainty, shifting expectations around interest rates, central bank buying, and investors quietly repositioning portfolios has pushed prices higher over time.

Markets over the past year haven’t exactly felt stable. Growth forecasts have been revised more than once, inflation hasn’t fully disappeared from the conversation, and geopolitical tensions have flared up often enough to keep risk managers nervous. When that happens, capital tends to drift toward assets that don’t depend on corporate earnings or political promises. Gold sits right in that category.

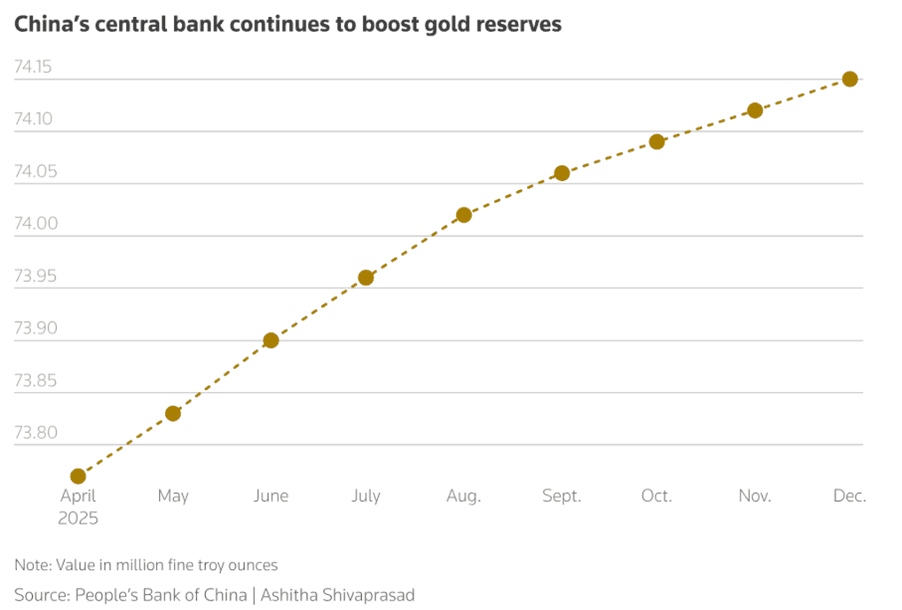

Central banks have also played a bigger role than many retail traders realise. Over recent years, several have increased their gold reserves as part of diversification strategies. These aren’t short-term trades. They’re long-term balance sheet decisions. And when buyers like that stay active, it tends to create a steady floor under the market, even when prices pull back temporarily. A prime example of this is China’s gradual increasing of gold reserves (Figure 2);

Interest rates are part of the story too, but not in a neat textbook way. Gold doesn’t earn yield, so falling real rates usually help. But this rally hasn’t been perfectly synced with rate expectations. There have been periods where yields stayed relatively high and gold still pushed upward. That tells you the move hasn’t just been about returns – it’s been about confidence, policy credibility, and risk protection.

Then there’s the US dollar angle. Because gold is priced in USD, currency moves naturally matter. A softer dollar tends to support gold by making it cheaper for international buyers. At the same time, when confidence in major currencies weakens, gold often benefits simply because it isn’t tied to any one country’s monetary system. In those moments, it stops behaving like a trade and starts behaving like insurance.

Momentum has added another layer. Once gold began breaking into new highs, investment flows picked up. ETFs, futures positioning, and speculative participation all increased as traders who normally focus on equities or FX started paying attention. That kind of flow can feed on itself for a while – rising prices attract buyers, which push prices higher again.

Of course, this cuts both ways. Gold isn’t immune to sharp pullbacks. When positioning gets crowded or sentiment shifts, corrections can be fast and uncomfortable. That’s part of trading this market. Strong trends rarely move in straight lines.

Because it reacts to more than just one theme. Inflation worries, growth slowdowns, currency moves, geopolitical risk, and central bank policy expectations can all feed into gold at different times. Very few markets respond to such a wide mix of drivers.

For traders, that makes gold more than just another chart to scalp. It becomes a macro barometer. A way to express broader views on risk, policy direction, and market sentiment. When you understand what’s happening behind the scenes – not just what the candles look like – gold price action starts to make a lot more sense.

No rally lasts forever. That’s just how markets work. But gold’s performance over the past year is a reminder of why it continues to hold a central place in global trading. Whether you’re trading it actively or simply using it as a reference point for market stress, gold remains one of the most useful instruments on the board.

We’ll never share your email with third-parties. Opt-out anytime.

Relevant articles

The Best & Worst Performing Currencies of 2025