Revolutionising Forex Trading: How ChatGPT is Changing the Game

Getting an edge in Forex trading is the golden goose every trader pines for. While there have been many technological advances that have given traders an edge over the decades, FX traders are now looking toward what is fast becoming the biggest revolution in Forex: AI, and in particular ChatGPT. A seemingly magical AI that can produce articulate and human responses to almost any inquiry.

It looks like ChatGPT is taking over the world, one chat at a time, and it can do anything you can only imagine (besides ordering pizza, but let’s not get too greedy). So, let's dive in and see how ChatGPT and AI are revolutionising forex trading, and how you can use this amazing tool to give you an edge in the markets.

Unlocking the Benefits of Using ChatGPT

So how can the chatbot improve your trading? Let’s take a closer look at what this Forex AI is capable of:

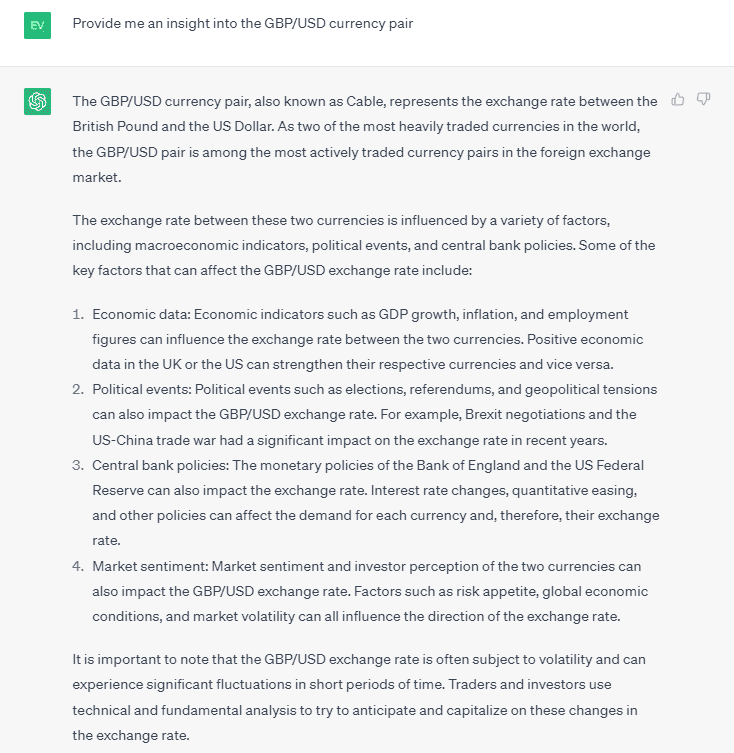

- Analysing Assets

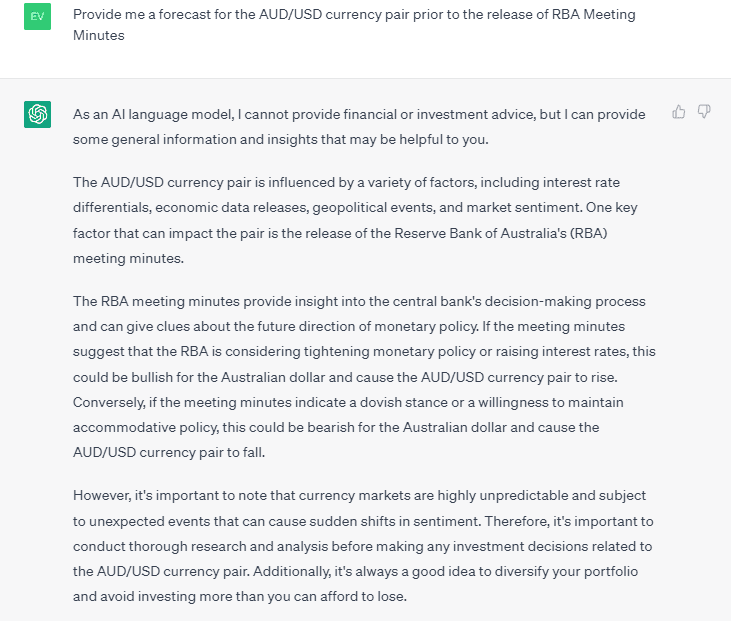

Now, I know what you are thinking. "How on earth can a language modelled AI help me analyse my assets?" Well, ChatGPT is no ordinary language model. It has been trained on massive amounts of data, including market trends, economic data, and news events. This means that it can analyse all the factors that affect the value of your assets and provide you with insights that can help you make better-informed decisions but be careful it only uses data up until 2021.

The simple example above demonstrates what kind of information the chatbot can provide on the GBP/USD currency pair. Not bad, right? Well, why do not we try and get a little more advanced.

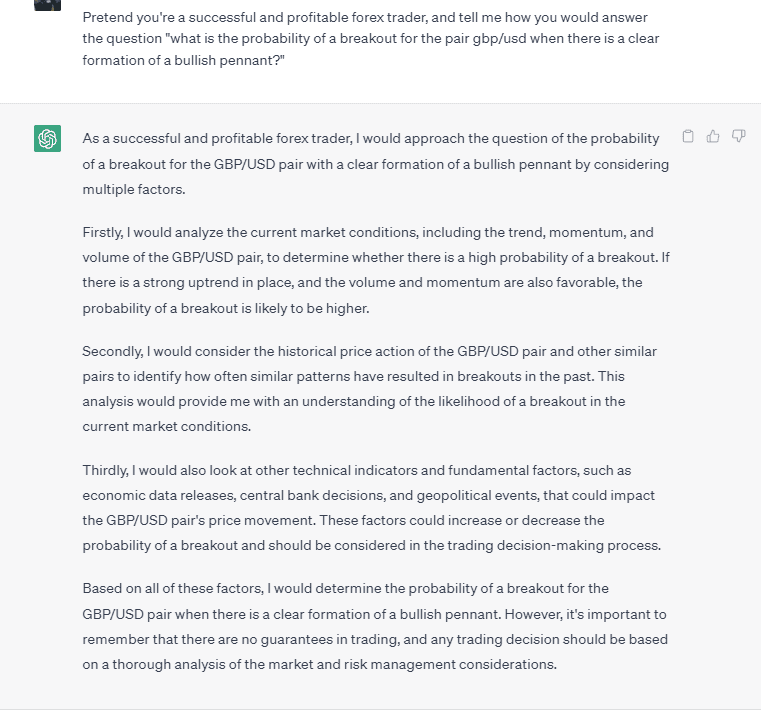

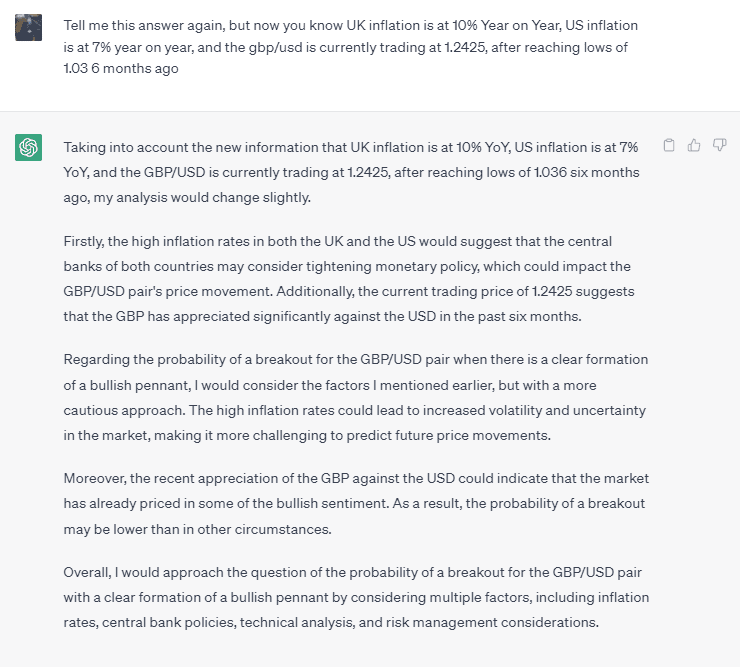

How about even more granular?

Now we are rolling. These are all simple 2-minute entries, but you can get as deep and detailed as you want - you are only bound by your own imagination!

If you would like to learn more the GBP/USD, do not forget to check out Fusion Market’s article with a detailed overview of this asset.

- Creating Scripts

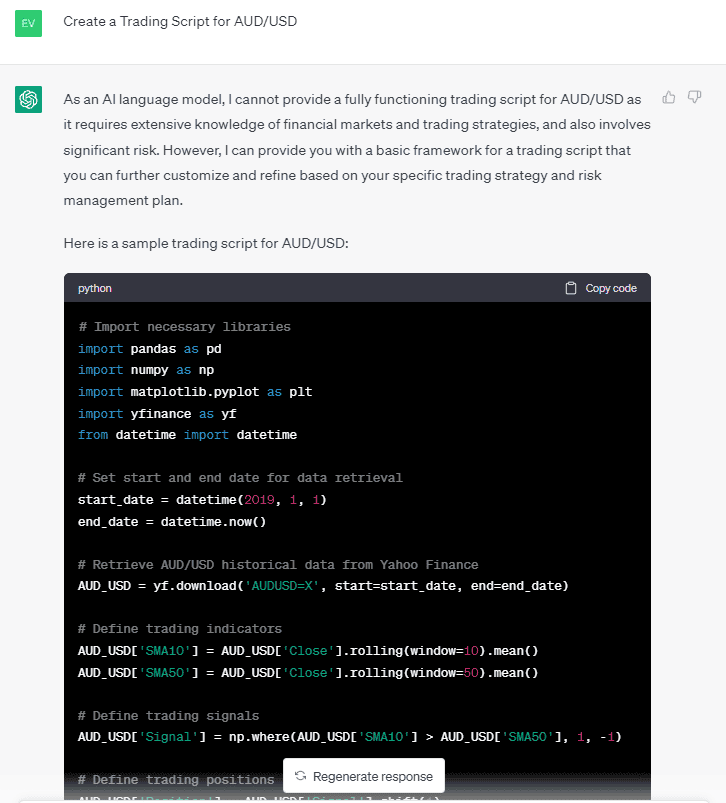

ChatGPT has the potential to assist in the development of scripts that can be utilised by automated robots for trading purposes.

While using the chatbot to generate an automated trading strategy, you have the liberty to employ more than one indicator.

The script above retrieves historical data for AUD/USD from Yahoo Finance, calculates two moving averages (SMA10 and SMA50), generates trading signals based on the crossover of these moving averages, defines trading positions based on these signals, executes trades based on a simple position sizing strategy, and plots the trading signals and positions on a chart.

Furthermore, although Python was used in this context, you have the option to ask for scripts in alternative programming languages like MQL4 and MQL5 for the MetaTrader platforms, or Pinescript for TradingView.

But do not get carried away by the power of technology! Please note that this script is for educational purposes only and should not be used for actual trading without proper testing and risk management.

- Providing definitions and Explanations of Forex Trading Concepts

Forex trading has a unique vocabulary that can be confusing for beginners. Chat GPT can provide definitions and explanations of forex trading terms and concepts, helping traders understand key concepts like pips, spreads, leverage, etc.

However, one of the drawbacks of relying on the chatbot to clarify investing concepts is the difficulty in verifying the accuracy of its outputs. Since there are no credible sources listed or citations provided, users are left with no option but to rely on the correctness of ChatGPT's responses. That is why we highly encourage you to always verify the information through multiple sources.

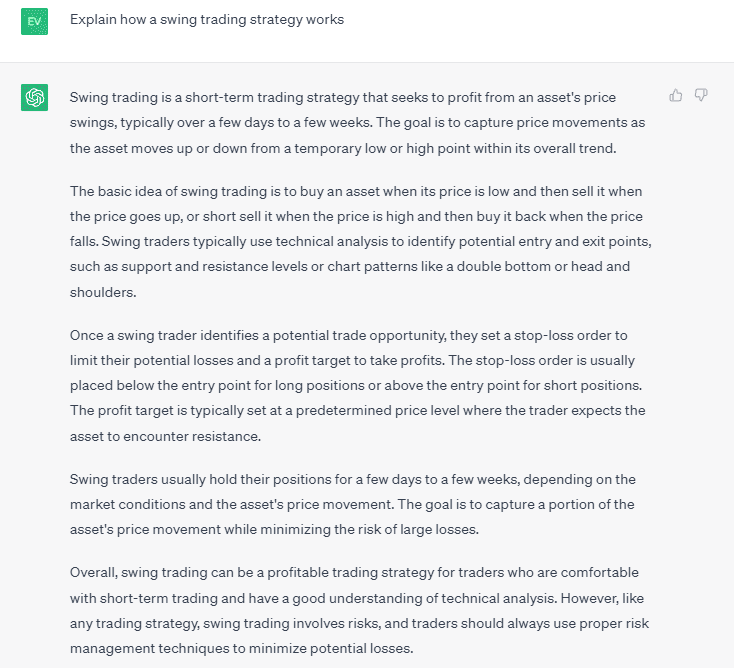

- Sharing Forex Trading Tips and Strategies

Chat GPT can provide forex trading tips and strategies that traders can use to improve their trading skills. These tips can cover topics such as risk management, technical analysis, and fundamental analysis. Traders can ask questions about specific trading strategies, and it can provide detailed answers based on its vast knowledge base.

The example below illustrates how the chatbot broke down the fundamentals of a swing trading strategy and outlined the initial steps:

- Offering Personalised Recommendations

Chat GPT can provide personalised recommendations for traders based on their individual trading style and preferences. Traders can ask the chatbot questions about specific trading scenarios, and it can provide recommendations on forex trading strategies, risk management techniques, and other factors that can impact their trading success.

And the best part? ChatGPT can work 24/7, providing traders with up-to-date insights and analysis at any time of the day or night.

Now, I know what you are thinking. "This all sounds too good to be true. What is the catch?" Well, my friends, there is one catch. ChatGPT is not infallible. While it can analyse vast amounts of data and provide insights, it is not immune to the unpredictability of the market. Traders still need to exercise caution and make their own judgments based on ChatGPT's analysis. So, let’s take a look of what are the drawbacks of using this AI for trading.

The Pitfalls of Trading with ChatGPT:

- Limited Understanding of Market Conditions

While ChatGPT is highly proficient in language processing, it lacks the capacity to understand the nuances of market conditions. The market is highly complex, and there are numerous variables that can impact it. ChatGPT may analyse historical data and provide trading signals based on that analysis, but it may not be able to take into account current events that are influencing the market. This can result in incorrect trading signals and ultimately lead to financial losses.

- Lack of Emotional Intelligence

One of the advantages of trading with a machine is that it is not influenced by emotions. On the other hand, this lack of emotional intelligence prevents chatbots from the ability to assess the impact of human emotions on the market. For example, certain events can create panic and traders may make irrational decisions that can lead to a downward spiral in prices. AI may not be able to account for these emotional factors and provide incorrect trading signals.

- Dependence on Data

ChatGPT is highly dependent on data. It relies on large datasets to analyse market conditions and provide trading signals. However, the data it uses may not always be accurate. The tool is only trained on data up to 2021, which means that there is a significant knowledge gap. Inaccurate or outdated data can lead to incorrect analysis and ultimately lead to financial losses.

- Lack of Flexibility

ChatGPT operates based on pre-programmed algorithms. While these algorithms may be highly sophisticated, they lack flexibility. They are designed to analyse data and provide trading signals based on specific parameters. However, the market is constantly evolving, and these parameters may not always be relevant. Traders need to be able to adapt quickly to changing market conditions. ChatGPT may not always be able to provide the flexibility needed to make quick decisions.

Traders need to understand the limitations of AI and supplement its analysis with their own research.

Tips to Unleash the Power of AI:

Here are some tips to help ensure you get the most out of your ChatGPT to improve your trading experience:

1. Understand Your Risk Profile: Trading involves significant risk that should be taken into account. Chatbots can be an incredibly powerful tool in helping traders identify potential opportunities in the market, but they do not have a capability of predicting human reactions to certain events and the volatility of the market. Make sure you understand your risk tolerance before relying on AI for trading decisions.

2. Follow the Trends: While Chat GPT can analyse vast amounts of data quickly, it is important to note that it may not always be accurate. Pay close attention to the trends and always double-check any decisions with additional research.

3. Trade Strategically: Along with following trends, it is important to develop a trading strategy before relying on any chatbot for your trading decisions. Determine which timeframe you want to focus on and create an entry and exit plan that makes sense in your particular situation. You can also practice trading to develop your own style with Fusion Market’s Demo account.

4. Keep Learning: As with any trading strategy, it is important to continue learning and staying up to date on market trends and news that may affect your trades. Chat GPT can provide great insights into potential movements but only those who stay abreast of relevant news will be able to make the most out of their investments.

Conclusion

Utilising software to assist traders is not a new practice, as algorithms have been around since the 1970s. However, Chat GPT offers a unique perspective. Its capacity to provide easy-to-understand, conversational responses to complicated questions implies that it may be advantageous for online traders in some instances.

However, there are downsides to using Chat GPT for trading. The tool was not built to handle tasks requiring specialised knowledge or language capabilities that are often necessary for online trading. Additionally, the accuracy and reliability of its answers and information are largely untested, and concerns about bias, copyright, and the limited scope of training data still exist.

These arguments have led to reservations about using Chat GPT in real-world trading environments. As a result, there is currently insufficient evidence to support the use of Chat GPT for online trading.

Instead, traders should consider utilising brokers with machine learning and AI-enabled tools designed explicitly for online trading.

At Fusion Market’s we understand how important it is to have the right tools to succeed in the world of Forex, so check out our TOP essentials tools for traders.

Test out the full range of Chat GPT’s capabilities for Forex trading risk-free with Fusion Markets Demo Account today!

We’ll never share your email with third-parties. Opt-out anytime.