What markets are actually pricing now

Is Inflation Really “Over”?

What markets are actually pricing now

Read Time: 3-4 minutes

If you only skim headlines, you’d think the inflation problem has already been wrapped up and put away. The language has softened. Central banks aren’t talking about emergency tightening anymore. Rate cuts get mentioned more often than hikes. And the word “transitory” has quietly made its way back into conversations.

Markets, though, are rarely that tidy.

Inflation might not be running at crisis levels anymore, but that doesn’t mean traders have stopped caring. Far from it. What’s changed is the question being asked. Instead of “how bad is inflation going to get?”, the focus has shifted to “how sticky is it, and what does that mean for rates, growth and asset prices?”

That’s a much messier problem to deal with.

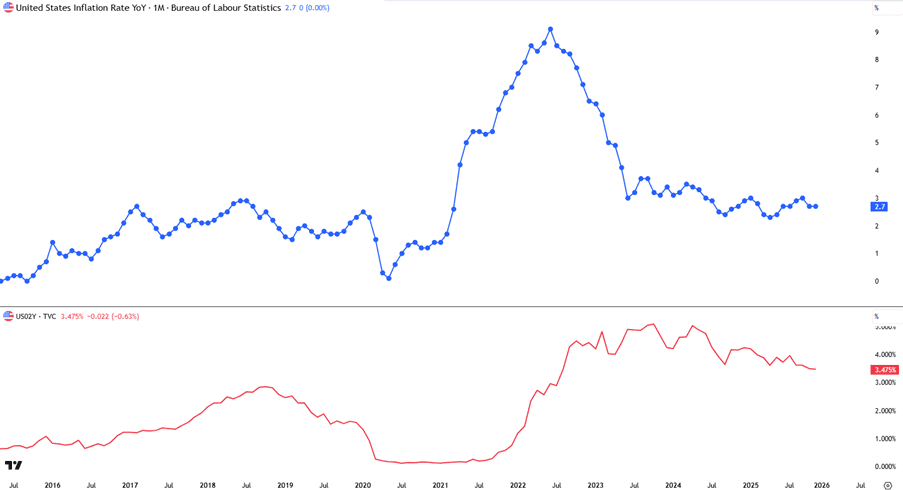

Cooling inflation doesn’t automatically mean everything goes back to normal (Figure 1). Prices can slow without actually returning to the low, predictable environment markets enjoyed for years. And right now, that’s exactly what’s happening. Headline inflation has eased, but parts of the economy – particularly services and housing-related costs – continue to behave stubbornly.

Figure 1 - US Inflation (Blue) vs US 2-Year Yields (Red)

From a trading perspective, that creates an uncomfortable middle ground. Inflation isn’t hot enough to force aggressive tightening, but it’s not low enough to give central banks full freedom to cut quickly. That uncertainty shows up everywhere: bond yields, currency moves, equity volatility. It’s the kind of environment where sentiment can flip on a single data release.

And that’s the part many newer traders miss. Markets don’t trade inflation itself. They trade expectations. If inflation prints slightly hotter than forecast, prices move. If it undershoots, prices move. It’s not about the number – it’s about whether it surprises the crowd.

If you really want to see what the market thinks about inflation, don’t just stare at CPI charts. Look at interest rate pricing. Bond markets, swap curves and futures markets tell you far more about where traders think policy is headed.

Right now, pricing suggests markets expect central banks to ease eventually, but not in the aggressive, rapid way that was being talked about at the height of rate-cut optimism. That hesitation matters. It signals that inflation risk hasn’t disappeared – it’s just been pushed further down the road.

One reason inflation keeps refusing to behave neatly is the labour market. Wage growth has stayed stronger than many forecasts expected. When wages rise faster than productivity, price pressures tend to linger. Businesses pass costs on. Consumers absorb some of it. The cycle stretches out.

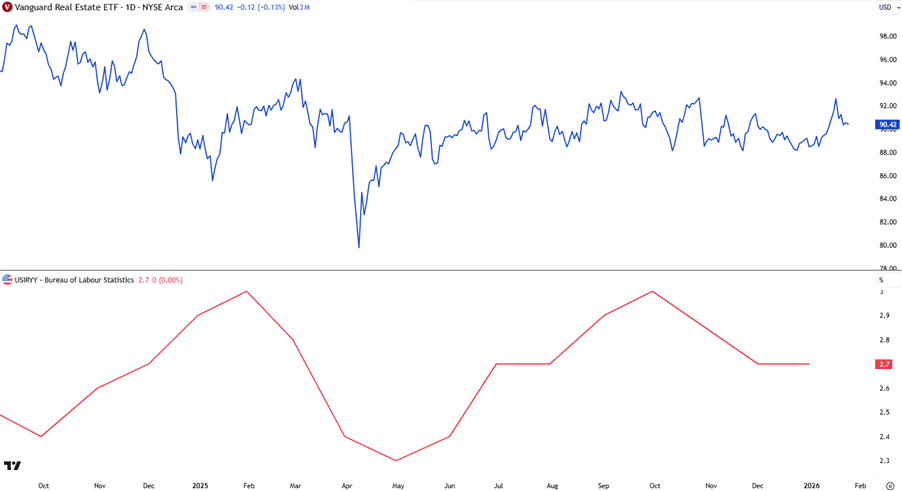

Housing adds another layer. Rent and housing-related components feed into inflation data with long delays. Even when broader inflation cools, these categories often stay elevated for months. That lag effect is one of the reasons central banks remain cautious even when headline numbers look better (Figure 2).

Figure 2 – Vanguard Real Estate ETF (Blue) vs US Inflation YoY (Red)

For traders, all of this changes how markets behave.

It means interest rate expectations stay front and centre. It means currencies react sharply to inflation surprises. It means equities don’t just care about earnings anymore – they care about what inflation data implies for policy direction. Sometimes “good news” even becomes bad news. A hot inflation print can hurt stocks but boost certain currencies. A soft print can lift equities while pushing yields lower. Context becomes everything.

Another common mistake is assuming inflation has a clear finish line. In reality, markets trade the path, not the destination. Every data release, central bank speech and economic update nudges expectations slightly higher or lower. That constant repricing is why markets remain jumpy even when inflation appears to be trending down.

It also explains why positioning changes so often. Traders aren’t trying to predict one final inflation number. They’re trying to stay one step ahead of how the narrative is shifting.

If “over” means we’re no longer dealing with runaway price growth, then yes – the worst of the surge appears to be behind us. But if “over” means returning to a world of ultra-low inflation, cheap money and predictable policy, markets are clearly not convinced.

What’s being priced right now looks more like a middle zone. Slower inflation, cautious central banks, and a market that remains sensitive to surprises.

For traders, that’s not necessarily a bad outcome. It means inflation data will continue to move markets. It means rate expectations will stay relevant. And it means macro-driven volatility isn’t disappearing anytime soon.

Which, in trading terms, usually translates to opportunity – as long as you’re paying attention.

We’ll never share your email with third-parties. Opt-out anytime.

Relevant articles