Opportunities in Currency Crosses: Non-USD Pairs Driving the Trends

Read Time: 3-5 minutes

When most traders think of the foreign exchange market, their first instinct is to look at the US dollar. It makes sense – the greenback sits at the centre of the global system, and pairs like EUR/USD, USD/JPY and AUD/USD dominate daily volumes. But focusing solely on dollar-centric trades can mean missing some of the most interesting moves happening elsewhere.

In 2025, several currency crosses have been carving out strong, sustained trends. For traders willing to step outside the dollar’s shadow, these moves can offer cleaner opportunities with less noise from US data releases and Federal Reserve speculation.

Crosses often fly under the radar, yet they reflect important dynamics in the global economy. For example, EUR/GBP is shaped by Europe-UK growth and interest rate differentials, whereas AUD/NZD is heavily influenced by commodity cycles and trans-Tasman policy divergences. Unlike USD pairs, which can be pulled in multiple directions by dollar flows, crosses often highlight more specific stories – giving traders a sharper lens on relative strength.

Another benefit is diversification. Trading crosses allows exposure to themes beyond the “dollar trade”. If everyone is crowding into USD longs or shorts, opportunities in crosses can offer trends that are less correlated and, in some cases, more predictable.

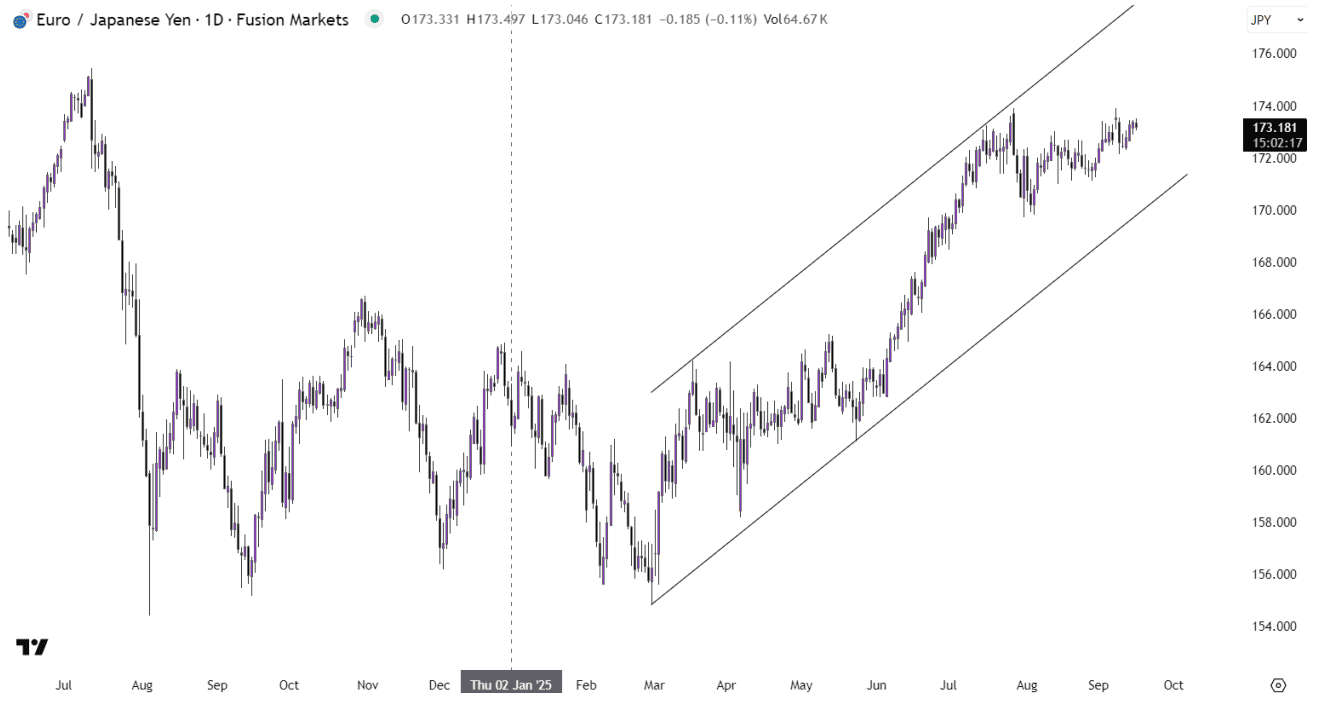

EUR/JPY: A Classic Carry Story

One of the strongest trends this year has been the relentless rise in EUR/JPY. Ultra-low Japanese rates continue to contrast with the European Central Bank’s cautious but positive stance. That yield gap makes the euro attractive to fund in carry trades against the yen. Every dip in EUR/JPY has been met with fresh buying, as investors recycle capital into higher-yielding European assets.

What makes this move notable is that it’s not purely speculative – Japanese investors themselves have been pushing money offshore, amplifying the upward momentum. For traders, EUR/JPY has offered a rare combination of trend consistency and healthy volatility.

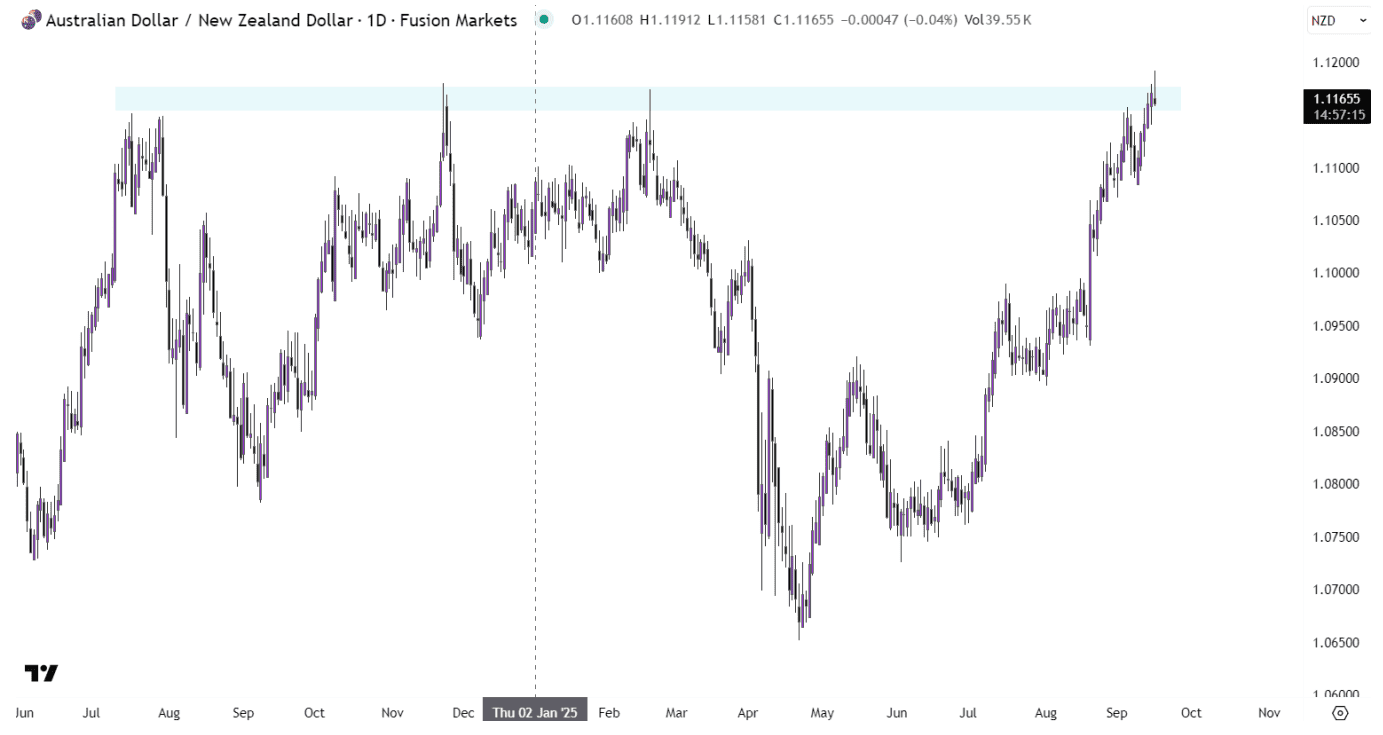

AUD/NZD: Policy Divergence Close to Home

Closer to home, the Australian and New Zealand dollars have diverged in interesting ways. The Reserve Bank of Australia has been more patient, signalling that rates may stay higher for longer given sticky inflation and stronger domestic demand. Meanwhile, New Zealand’s economy has softened, with the Reserve Bank of New Zealand leaning more dovish.

The result has been a steady grind higher in AUD/NZD to previous levels, after a poor start to the year. For traders used to the cross being range-bound, this year has shown how quickly relative central bank paths can unlock directional opportunities.

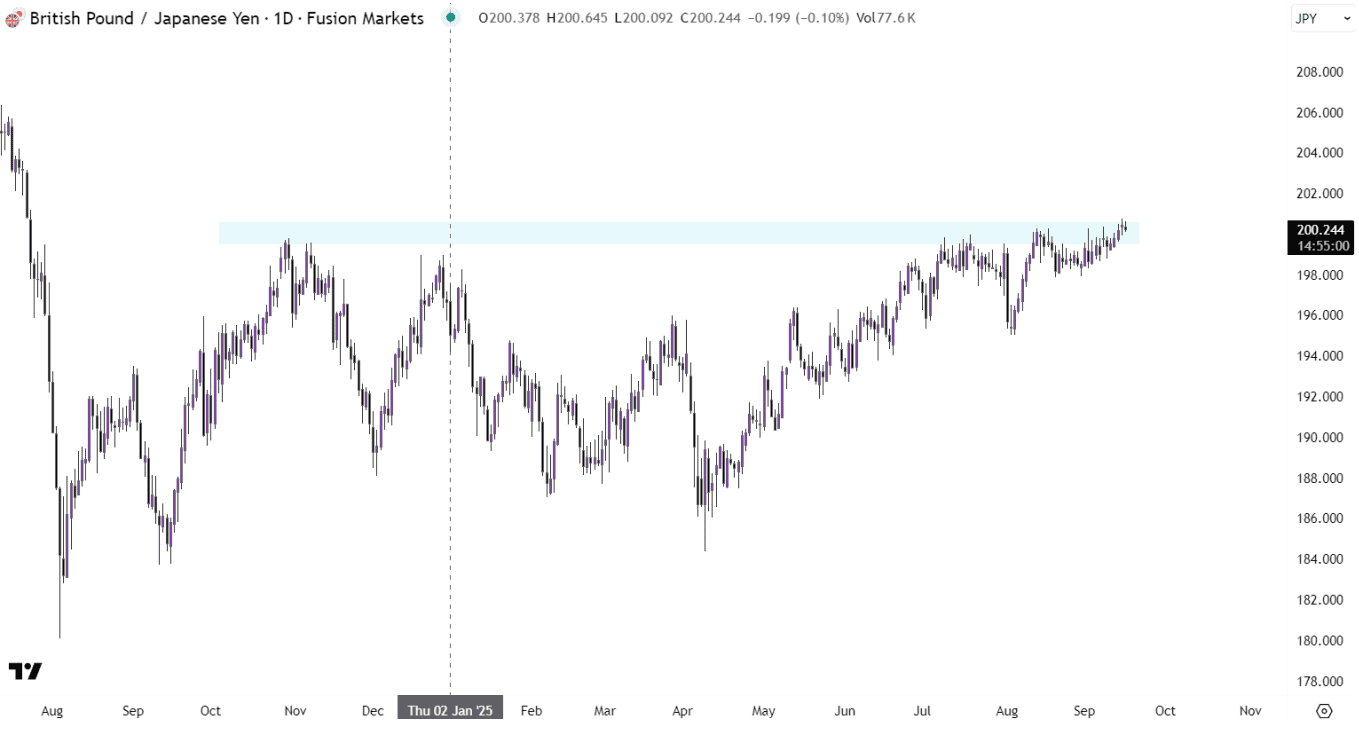

GBP/JPY: Volatility with Direction

For those seeking volatility, GBP/JPY has been one of the most rewarding trades. Sterling has held up surprisingly well despite political noise in the UK, supported by still-elevated inflation and the Bank of England’s reluctance to ease aggressively. Paired against the yen, the pound’s resilience has translated into sharp upward moves. Like other crosses, the pair started the year off on a slight decline, before establishing a trend to the upside, reaching prior highs around 200.00.

However, GBP/JPY isn’t for the faint-hearted – swings can be violent, and position sizing is crucial – but for trend traders, the bias has remained firmly higher.

When trading crosses, it’s not enough to follow the headline moves. Success often comes from tracking the relative policy and growth narratives in each economy:

- Central banks: Who is closer to cutting rates, and who is staying tight?

- Inflation trends: Relative inflation pressures drive yield spreads, which feed directly into crosses.

- Regional growth stories: Strong commodity demand, trade flows, or political risks can tilt the balance quickly.

Technical analysis can also play a bigger role in crosses. Because liquidity is slightly thinner than in major USD pairs, trends often extend further than expected before reversing. Chart levels, momentum indicators, and moving averages tend to be respected as traders look for guidance in less-watched pairs

Opportunities in non-USD currency crosses are more abundant than many traders realise. EUR/JPY and GBP/JPY highlight the impact of yield gaps, AUD/NZD reflects trans-Tasman divergence, and EUR/CHF shows how safe-haven currencies can shift when central banks change tack.

For those willing to broaden their focus beyond the dollar, these pairs can provide clean directional opportunities – and in many cases, trends that are easier to follow. In a market often dominated by the US narrative, looking to crosses can help uncover the quieter but equally profitable stories playing out around the globe.

We’ll never share your email with third-parties. Opt-out anytime.