TradingView vs. MetaTrader

Read time: 8 minutes.

For technical analysis traders, choosing the right trading platform is crucial for success. In this article, we'll compare two industry-leading platforms: TradingView and MetaTrader, highlighting their unique features and helping you decide which one best suits your trading style.

Table of Contents

- Key Takeaways

- TradingView Overview

- MetaTrader Overview

- Platform Comparison

- Which Platform is Right for You?

- Conclusion

Key Takeaways

- TradingView offers an intuitive interface and advanced charting tools, ideal for visual learners and technical analysis.

- MetaTrader provides powerful automation capabilities and faster execution, especially suitable for experienced traders.

- TradingView is powered by cTrader, which may introduce some lag but offers simple bot creation with PineScript.

- MetaTrader has an older interface but excels in customization and supports a wider range of markets, including stocks.

- Both platforms can be connected to your Fusion account for direct trading.

Consider trialling both platforms on a demo account to determine which best fits your trading style.

TradingView

TradingView is renowned for its user-friendly interface and advanced charting tools. It caters to traders of all levels, offering an intuitive design that simplifies the trading process. One of TradingView's standout features is its extensive library of indicators and drawing tools, making it a favourite among visual learners who rely heavily on technical analysis. There’s almost no drawing tool or indicator that you cannot find on TradingView.

TradingView's interface is not only easy to navigate but also highly customisable, allowing users to set up their workspace according to their preferences. This flexibility is particularly beneficial for traders who like to have all their essential tools and information readily accessible. And the best part, it syncs across all your devices, with a downloadable app for your phone and computer.

The platform also has a strong community aspect, allowing traders to share ideas, strategies, and charts with others. This social feature provides a collaborative environment where traders can learn from each other and share strategies and technical tools.

The platform's social network is vibrant, with millions of traders from around the world sharing their insights and analysis. This community-driven approach can be incredibly valuable for both novice and experienced traders looking to gain different perspectives and improve their trading strategies.

TradingView provides most of its products for free, but its paid subscription-based model is what really brings it to life. With additional chart types and the ability to load multiple charts on one screen, the value is present for technical-based traders.

For traders, understanding how to read the forex economic calendar is crucial, and TradingView makes it easy to stay informed. Major economic events, such as interest rate announcements, employment reports, and GDP releases, can significantly impact market movements. The economic calendar provides traders with a roadmap of these events, helping them anticipate volatility, make informed trading decisions, and align their strategies with broader economic trends. With TradingView, traders can seamlessly integrate these key dates into their workflow, ensuring they are prepared to respond effectively to market changes.

MetaTrader

MetaTrader is arguably the most well-known forex trading platform. Having been around for a very long time (2005), it’s long been the go-to for most traders, with most now using MetaTrader4, or MetaTrader5.

Known for its powerful automation capabilities, which are particularly appealing to experienced traders, the platform offers advanced features such as Expert Advisors (EAs), allowing users to automate their trading strategies. This can be a game-changer for those who want to implement complex trading systems without constant manual intervention.

MetaTrader’s automation capabilities extend beyond just executing trades. The platform allows traders to back-test their strategies using historical data, providing valuable insights into the potential performance of their trading systems. This feature is particularly useful for traders who wish to develop their own EAs and want to ensure they perform well under various market conditions.

Though somewhat dated, MetaTrader provides deep market access with features like multiple order types, comprehensive charting tools, and a range of technical analysis options. Its robust architecture supports a wide array of customisations and add-ons, giving traders the flexibility to tailor the platform to their specific needs. Whether you are trading forex, commodities, or CFDs, Meta Trader's extensive range of tools and functionalities ensures you have everything you need to make informed trading decisions.

MetaTrader is completely free to use, with the option of purchasing additional EA’s, drawing tools, or various other add-ons from third-party users through the MQL5 market.

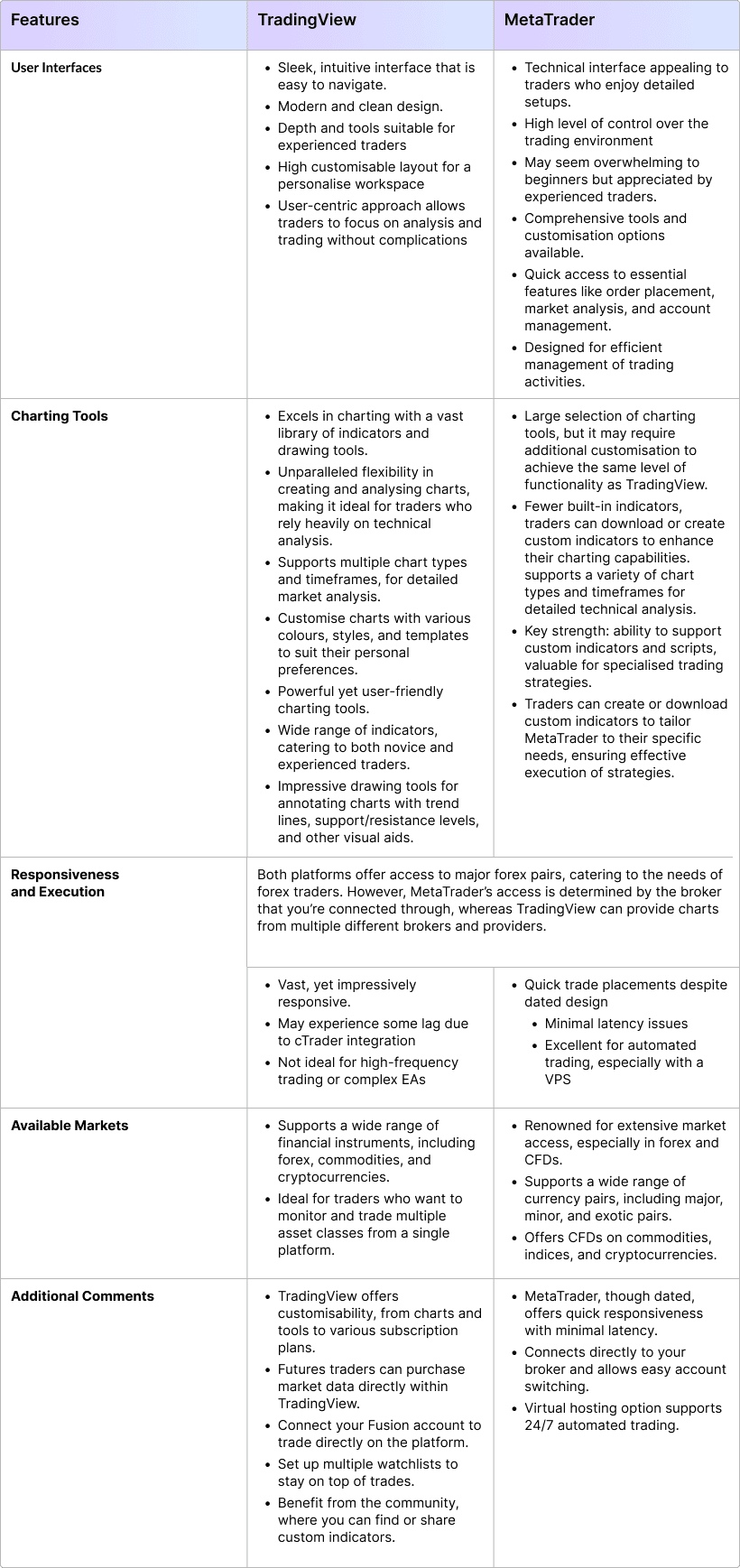

Forex Platform Comparison: TradingView vs. MetaTrader

Which is Right for You?

Choose TradingView if you value:

- Intuitive interface and advanced charting tools

- Community insights and social trading features

- Ease of use for beginners

- Simple bot creation with PineScript

Choose MetaTrader if you prioritise:

- Powerful automation capabilities with Expert Advisors

- Fast execution speeds, especially with a VPS

- Access to a wide range of markets, including stocks

- Advanced customisation and flexibility

Conclusion

Both TradingView and MetaTrader offer unique strengths that cater to different trading styles and preferences. Consider your trading goals, experience level, and the features most important to you when making your choice.

We recommend trialling both platforms on a demo account to determine which suits your trading style best. Both can be connected to your Fusion account for direct trading.

For More Information:

- TradingView with Fusion Markets

- MetaTrader 5 with Fusion Markets

- Learn more about PineScript

- Explore our sponsored VPS options

Still unsure? Reach out to our friendly help team at [email protected] using the chat function on the bottom right of this screen.

We’ll never share your email with third-parties. Opt-out anytime.