USD/CNH (USD/CNY): An Overview

The foreign exchange pair USD/CNH (or otherwise known as USD/CNY) is the trading ticker symbol for the powerful but volatile pair of the United States dollar and Chinese Renminbi. Chinese Renminbi is the official currency of the People’s Republic of China, but each individual unit of currency is called Yuan. These two are considered as “exotic” or volatile pairs, mainly because a major currency, USD, is paired with that of an emerging nation, CNH.

While considered volatile and generally treated with higher liquidity, the USD/CNH pair is the combination of the world’s two largest economies. The unique relationship between the two countries of the two currencies makes the combination both potent and fascinating.

CURRENCY BACKGROUND

United States Dollar

The United States Dollar is the official currency of the United States of America and several other countries. It is popularly known as the “greenback” due to the bills’ predominantly green color.

The Coinage Act of 1972 paved the way for the introduction of the US dollar. The fiscal policy of the United States is under the control and supervision of the Federal Reserve System, which serves as the nation’s central bank as well.

Chinese Yuan

The Renminbi is the official currency of the People’s Republic of China. The Yuan is the basic unit of the Renminbi, but it is also used to refer to the currency in general, especially in an international context.

In 1948, or one year before the establishment of the People’s Republic of China, the People’s Bank of China (PBOC) introduced the Renminbi. As the new government of China expanded its hold on its territories, it began to steadily issue the Renminbi so as to have a unified currency in the land. Since then, the Renminbi, or Yuan, has been in circulation and has been the official currency of China.

IMPLICATIONS OF USD/CNH CURRENCY PEGGING

The US and China have always had a love-hate relationship that greatly affects not only their trade relations but that of the world as well. The past decades saw a series of pegging and de-pegging between the two currencies. Here are a few key periods that saw the biggest impact and highlighted the importance of currency pegging.

1995-2005

The US Dollar is freely convertible into all currencies of developed economies. On the other hand, the Chinese government is managing the Chinese Yuan’s value. From 1995, Chinese Yuan was at a “hard currency peg” at 8.38 against the US Dollar. For a decade this seems to be the case, and for this reason, it received wide criticism, mainly from the US government. The expectation that there should be a movement in the currency exchange of Yuan (given that China’s economy saw big growth) was not seen. This move by China is seen to protect its interest as, by artificially keeping the value of the Yuan down, Chinese importers were given a competitive advantage: a lower Yuan exchange rate reflects a stronger Chinese currency because you would need fewer Yuan to purchase one US Dollar.

2005

July of 2005 saw a revaluation of the Yuan by the People’s Bank of China by 2.1 percent. PBOC likewise announced a shift to a “soft peg,” which will allow the Yuan to trade more freely within a certain managed exchange rate range. While some criticized the change for being too “insignificant,” many economists praised the move and saw it as the first step towards a more flexible currency exchange system.

2010 - present

Since 2010, China continued its efforts of reforming its exchange rate system by giving the buying and selling forces in the market a freer reign in determining the exchange rate.

IMPORTANT THINGS TO CONSIDER WHEN TRADING USD/CNH IN FOREX

Federal Reserve and People’s Bank of China

Federal Reserve

The Federal Reserve, or most commonly known as The Fed, is the United States’ central bank. It is responsible for the monetary policies of the nation and sets the interest rates of the dollar investments eight (8) times in any given year. The Fed provides direction to strengthen the US Dollar and in maintaining its fluidity and stability.

People’s Bank of China (PBOC)

PBOC is China’s central bank. It has the duty of implementing monetary policies – even unconventional ones – to ensure that CNY remains competitive and afloat. PBOC likewise sets a daily midpoint rate, which serves as a basis in trading Renminbi or Yuan within 2% in either direction.

Trade Wars

Being major players in the international trading arena, trade wars in the form of imposition of additional tariffs and sanctions greatly affects the values of the currencies. In the 2018-2019 US-China Trade standoff, when Trump imposed a series of sanctions against China’s products and exports, China retaliated by lowering the exchange rate value of CNY below its USD peg.

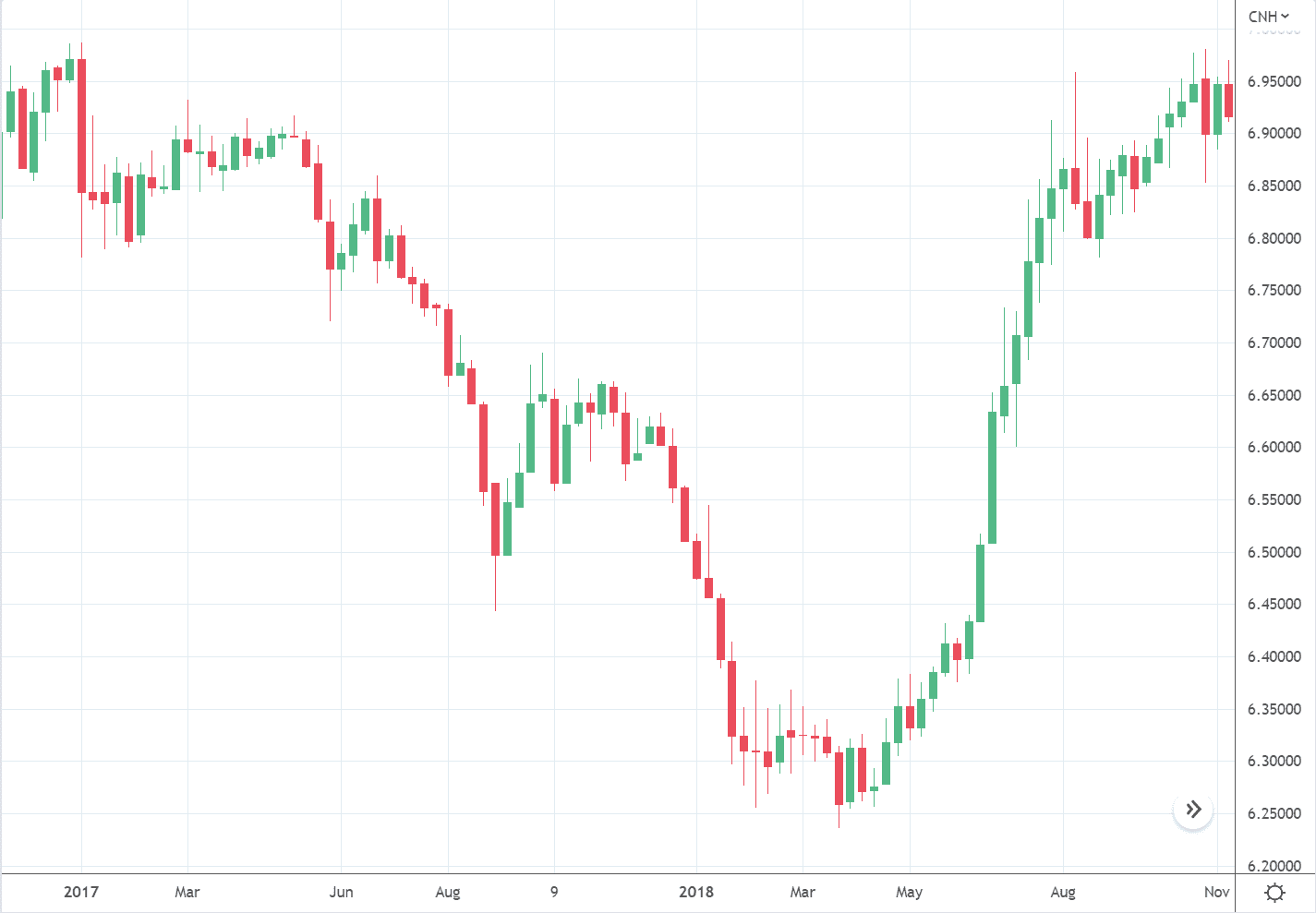

USD/CNH Weekly - Nov 2017-2018

USD/CNH Weekly - Nov 2017-2018

CONCLUSION

Is the USD/CNH worth the risk for your investment?

As a volatile combination, is it worth the risk to invest in USD/CNH?

While it seems counterintuitive, the pair remains to be one of the most popular, given that the combination represents two of the most powerful economies in the world.

The US Dollar is the world’s primary reserve currency, and remains to be the most widely used currency when it comes to international transactions. The Chinese Yuan represents the continuous and rapidly rising economy of China, the world’s largest exporter. Their advantages when taken individually could be the pair’s strength when taken cumulatively.

We’ll never share your email with third-parties. Opt-out anytime.