How to Use AI to Enhance Your Trading Performance

Read Time: 3-4 minutes

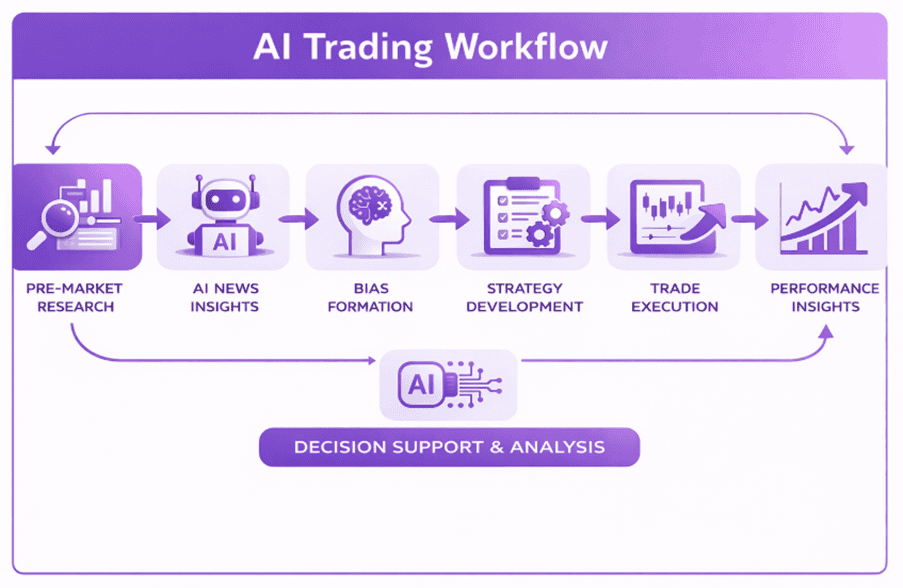

Artificial intelligence has quickly become one of those buzzwords that gets thrown around in trading circles – usually alongside images of complex algorithms and fully automated hedge fund systems. But for most traders, that framing misses the point entirely.

You don’t need to build a machine-learning model or run a quant desk to benefit from AI. In reality, its biggest value sits in the day-to-day – helping you prepare faster, organise your thinking, and cut through the noise that comes with modern markets.

Think of AI less as a trade generator and more as a second set of eyes. It won’t replace your judgement, but it can sharpen it. Whether you’re scanning macro headlines before London open or trying to structure a trade idea that’s still half-formed in your head, AI can step in to speed up the process and add clarity where it’s needed most.

Used properly, it becomes part of your routine – not something futuristic, but something practical that quietly improves how you operate.

- Use AI for Pre-Market Preparation

- Generate Structured Trade Ideas

- Build or Refine Trading Strategies

- Improve Your Trade Journal Analysis

- Strengthen Risk Management

- Automate Routine Trading Tasks

- Accelerate Your Learning Curve

- Final Thoughts

Most traders know the feeling – you sit down at the charts, coffee in hand, and suddenly realise you’re already behind. Overnight headlines, central bank commentary, commodities moves, bond yields… there’s a lot to catch up on before you’ve even looked at price action.

This is where AI becomes immediately useful.

Instead of jumping between news sites and economic calendars, you can consolidate the big picture in minutes. It’s not about replacing research – it’s about filtering it.

For example, before the session begins, you might ask:

• “Summarise the key macro themes driving FX markets right now.”

• “What developments overnight could impact AUD and NZD today?”

• “Give me the market reaction to the latest Fed commentary.”

Within seconds, you’ve got a structured overview that would normally take far longer to piece together manually.

What makes this powerful is the mental clarity it creates. Rather than reacting to charts in isolation, you’re approaching the market with context – yields, risk sentiment, commodities, policy expectations – all sitting in the back of your mind as you analyse setups.

It doesn’t mean you blindly follow what AI produces. Think of it as your pre-market briefing note – a starting point that helps you form your own bias before the trading day properly gets underway.

AI is particularly useful when you have a macro or technical view but want to structure it into a tradable framework.

Try prompts like:

• “If I expect US yields to rise, which currency pairs are most likely to be impacted and why?”

• “Provide bullish and bearish trade scenarios for Gold based on inflation expectations.”

• “Turn this market view into a step-by-step trade plan with entry, stop, and target logic.”

This process forces clarity. It transforms loose ideas into defined setups, which is critical for consistency.

You don’t need coding experience to start systematising your approach. AI can help translate discretionary concepts into rule-based frameworks.

Useful prompts include:

• “Convert a Fibonacci pullback strategy into mechanical trading rules.”

• “How could I automate a London session breakout strategy?”

• “Suggest filters to avoid ranging market conditions in trend strategies.”

You can take this further by asking AI to help draft scripts for platforms like TradingView or MetaTrader, turning theory into something testable.

Most traders keep journals – but far fewer extract meaningful insights from them. AI can review performance data and highlight behavioural patterns.

For instance:

• “Here is my last 50 trades. What patterns or mistakes stand out?”

• “Do my losing trades cluster around certain sessions or volatility levels?”

• “How can I improve my risk-to-reward profile based on this data?”

This creates an objective feedback loop, removing emotional bias from self-assessment.

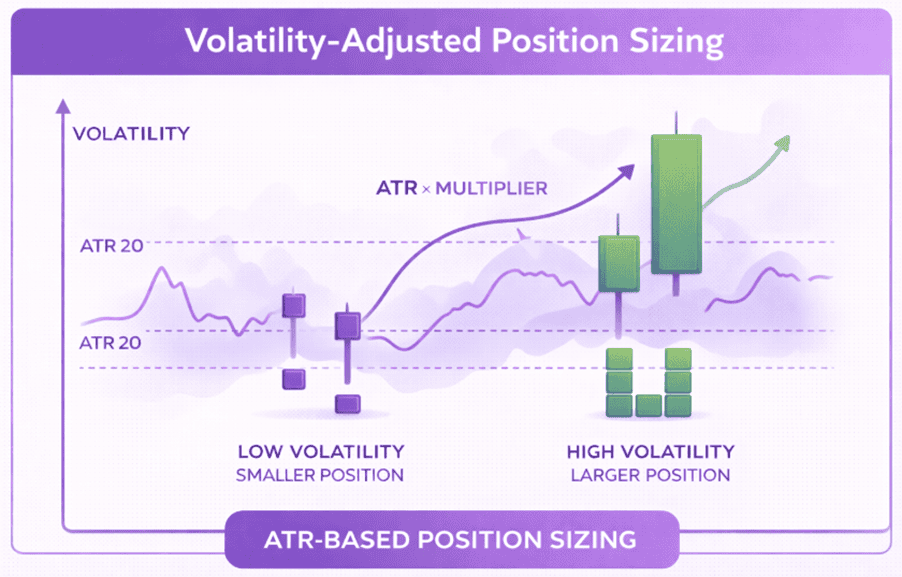

Risk is often treated as static – fixed lot sizes, fixed percentage risk. AI allows for more dynamic thinking.

You might ask:

• “How should position sizing change in high-volatility environments?”

• “What is the correlation risk of holding AUDUSD and NZDUSD simultaneously?”

• “Build a portfolio heat model for my current open trades.”

This shifts risk management from reactive to proactive.

Not every edge comes from analysis – some come from efficiency. AI can assist with:

• Drafting daily market outlooks

• Writing trading plans

• Summarising central bank speeches

• Creating back-test review notes

Prompts such as:

• “Write a pre-market checklist for an intraday FX trader.”

• “Create a post-trade review template I can reuse.”

These small automations free up mental bandwidth for higher-value decision-making.

AI also functions as an on-demand trading mentor. Instead of piecing together education from scattered sources, you can ask:

• “Explain yield curve inversion and its FX impact.”

• “How do real yields influence Gold prices?”

• “Teach me intermarket analysis step by step.”

Complex topics become digestible, allowing traders to build macro and technical fluency faster.

The traders getting the most out of AI aren’t using it to replace their judgement, they’re using it to enhance it. Think of AI as a research assistant, strategy consultant, and performance coach rolled into one.

It won’t predict the next market move with certainty. But it will help you prepare better, think more structurally, and operate more efficiently.

And in trading, marginal improvements in process often translate into meaningful improvements in performance over time.

We’ll never share your email with third-parties. Opt-out anytime.

Relevant articles