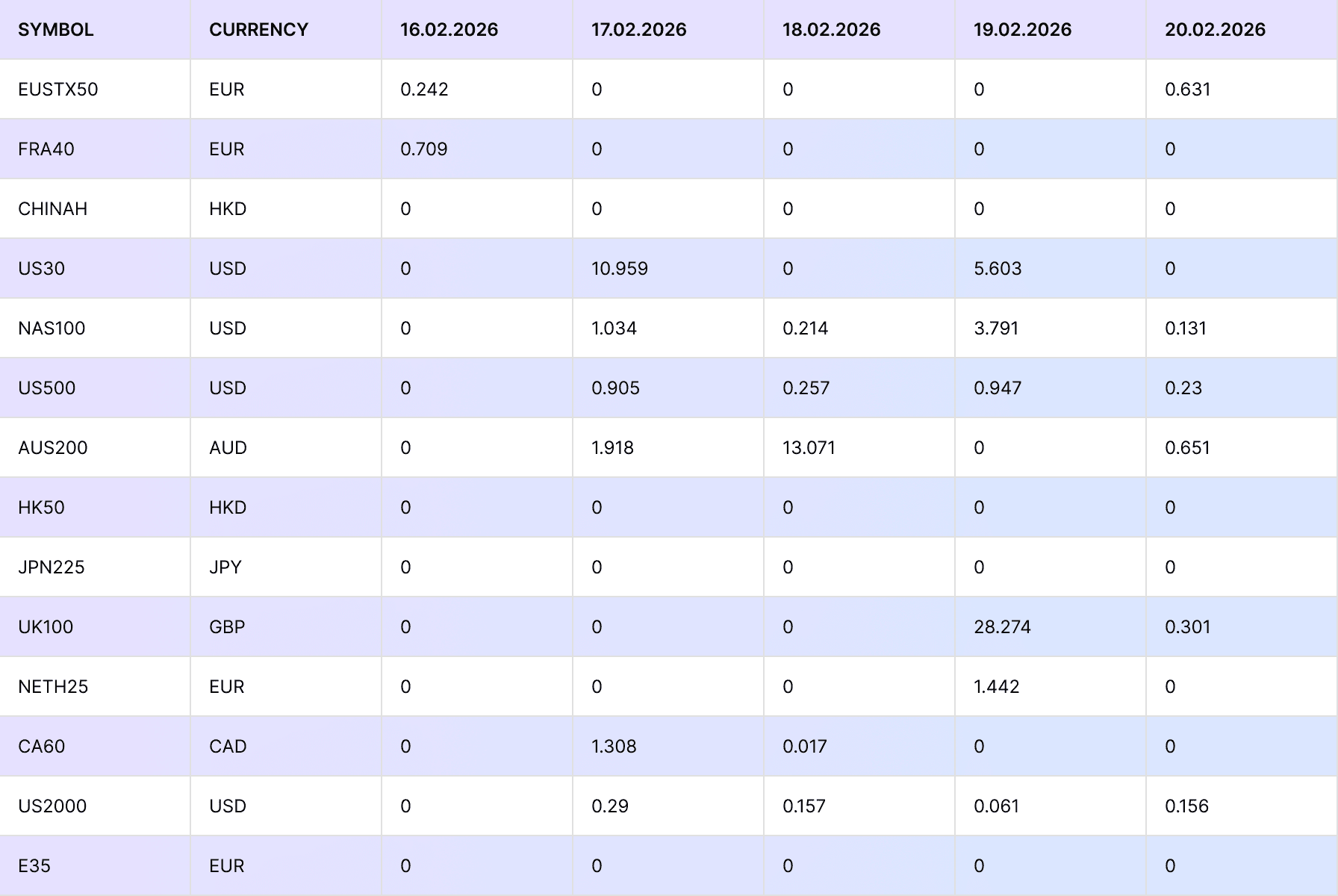

Index CFD Dividends | Week 16/02/26

Read time: 3 minutes.

Indicative Dividend Adjustments for Indices: Week Starting February 16th, 2026.

* Please note these figures are quoted in the index point amount and are subject to change

What is a dividend?

Dividends are a portion of company earnings given to shareholders. As indices are often composed of individual shares, an index dividend pays out based on individual shares proportional to the index’s weighting.

Trading on a CFD Index does not create any ownership of the underlying stocks, or an entitlement to receive the actual dividends from these companies.

What is an ex-dividend date?

An ex-dividend date is the cut-off date a share must be owned in order to receive a dividend. If an investor buys a share after the ex-dividend date, then they will not be entitled to earn or pay the next round of dividends. This is usually one business day before the dividend.

Do dividends affect my position?

Share prices should theoretically fall by the amount of the dividend. If the company has paid the dividend with cash, then there is less cash on the balance sheet, so in theory, the company should be valued lower (by the amount of the dividend).

Due to the corresponding price movement of the stock index when the ex-dividend date is reached, Fusion must provide a 'dividend' adjustment to ensure that no trader is positively or negatively impacted by the ex-dividend event.

How will the dividend appear on my account?

The dividend will appear as a cash adjustment on your account. If your base currency is different from the currency the dividend is paid out in, then it will be converted at the live FX rate to your base currency.

Why was I charged a dividend?

Depending on your position, given you are holding your position before the ex-dividend date, you will either be paid or charged the amount based on the dividend. Traders shorting an index will pay the dividend, whereas traders who are long the index will be paid the dividend.

Why didn’t I receive my dividend?

You may not have received a dividend for a number of reasons:

- You entered your position after the ex-dividend date

- You are trading an index without dividend payments

- You are short an index

If you believe the reasons above do not apply to your position, please reach out to our support team at [email protected] and we’ll investigate further for you.

We’ll never share your email with third-parties. Opt-out anytime.