Your reptile brain is hurting your trading

These are unprecedented times for all of us. Not only have we seen the financial markets crash, moving from an 11-year bull market into a bear market, with a -33% correction (only to see it bounce back up 25%!), in less than a month, but we have also seen the oil price collapse, thanks to a price war between two of its biggest producers and an oversupply. On top of which we have the small matter of the Coronavirus and associated lockdowns and isolation to contend with. What a time to be alive!

Life has changed dramatically in the space of just a few weeks and things we took for granted can no longer be relied upon.

If you watched the way the financial markets have been performing over recent weeks you will have experienced a rollercoaster of emotions that has matched, if not exceeded the peaks and troughs of the market. What kind of market are we in? General fear and greed? Are professional Investors rushing to cash and dumping everything they can? Algorithms? Passive Investing/ETFs exacerbating moves? Everything and anything is being put on the table but these moves are unprecedented.

If you're not confused, you're not paying attention.

You‘ve probably been conflicted, part of you may have wanted to bury your head in the sand and hope it all goes away. Another part of you may have wanted to sell everything and “head for the hills” except (literally speaking) of course you can't because you are under lockdown.

Let’s be clear these are stressful times. Even hard-nosed professional traders who have seen market crashes before are in unchartered territory at the moment and are trying to work out what to do next.

And just like you, they have been behaving a bit like a rabbit caught in the headlights. That is, not sure whether to run or stay put.

Before we can decide what to do next, we need to take a step back and examine why we’ve been behaving and thinking as we have.

Firstly, we need to realise that it's not personal or unique to us. Everyone is stressed at the moment, they are out of their routine and under immense pressure. concerned for the wellbeing of families, friends and finances.

At times like these our everyday decision-making processes take a back seat and the way our brain and body operates undergoes subtle but important changes.

When we are severely stressed our blood chemistry changes dramatically, adrenalin, noradrenaline and cortisol are produced by and pumped around our bodies.

These chemicals increase our heart rate, our pace of breathing. and ready our muscles for action. Without us being aware of it we are preparing for fight or flight.

Why does this happen?

Well, the truth is that a prehistoric part of our brain is taking control of our actions. There are "Two-yous" in your brain. A rational, deliberate, thoughtful you. And an emotional, fast-thinking you.

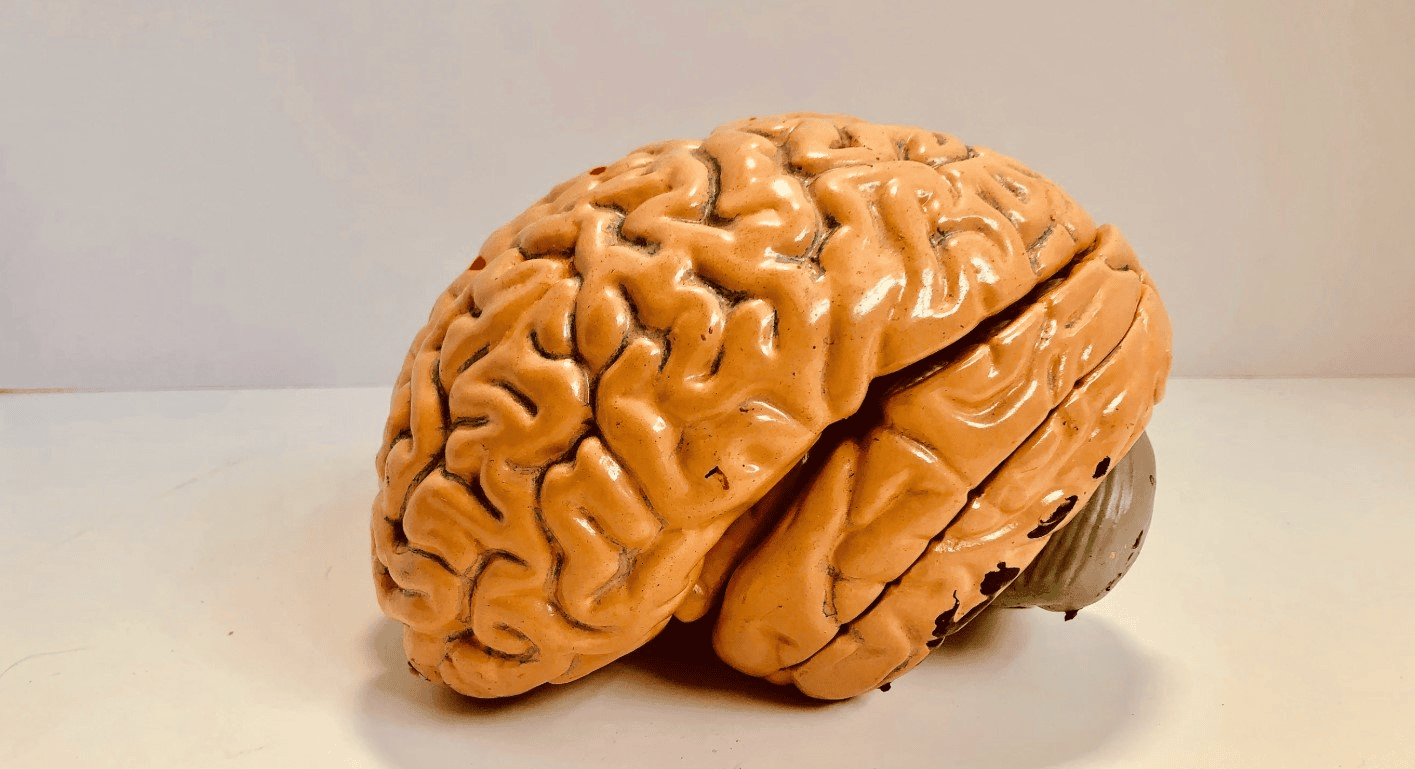

The frontal cortex of our brain, which is the part of the brain that we normally use for decision making, becomes less active and a part of the brain that's sometimes referred to as our reptile mind, called the amygdala, takes over.

The amygdala is an almond-shaped cluster of neurons and nuclei buried deep in our brains, frankly, it’s a “throwback”. It has its own independent memory systems and it deals with our emotional and physical responses to stress and fear.

The amygdala evolved to make us alert to danger and to keep us alive if, for example, we came face to face with a large predator. These days, for most of us, confronting a large predator, is a remote possibility.

However, the amygdala's response to heightened levels of stress and stressful situations have become baked into our brains thanks to millions of years of evolution. Such that it’s become part of our subconscious, and something we are only faintly aware of and are not able to control.

So if you have been watching the markets or financial TV recently and have felt your heart pumping, your brow sweating, your muscles tensing and have found yourself only able to focus on the screen, even ignoring someone who is speaking to you, in the same room, you are not alone or to blame. You only need to watch five minutes of television or visit a news site to see blaring counts of the death toll, economic shutdown and other news that puts your amygdala in the driver's seat.

When our reptile brain takes over our decision making becomes short- term and driven by fear and our long-term strategic thinking goes completely out of the window.

That's why it's so dangerous to make financial decisions under stress at the heat of the moment if you will. A few rash decisions or actions that are taken then can easily undo years of hard work.

So how can we try and counteract these primaeval forces in our brain and psyche?

Well, the first thing to do is break the cycle, so walk away from the source of stress be it the TV or the computer screen and gather yourself. If you can get into the garden or get some fresh air for a few minutes that will help.

Having removed yourself from the situation you can try to re-impose some order.

Think about the timescales you are investing or trading over. If you are trading FX you may be taking short term positions, but they are likely to be part of a longer-term plan. Perhaps you can re-appraise this as a once in a generation buying opportunity?

Remind yourself what your investing goals are and over what time scales were you trying to achieve them.

I very much doubt your plan was about weeks or even months was it?

Your plans were probably conceived to play out over several years, weren't they?

It also helps to think about who you are investing and trading for and why.

Perhaps it's for you and your family or other loved ones, thinking about these long-term goals can help you centre yourself once more. When I'm investing or trading I think about 65 year old me retiring and ask myself "Will I care about today's trading result then? Or even in one year?"

If you do need to make a decision or take action on your portfolio, try to make that decision when the markets are shut and you are free of distraction. You will find that you can think a lot more clearly in those circumstances. That clarity is only likely to benefit your finances over the longer term. Take a minute to take some deep breaths.

Remember, this too shall pass.

We’ll never share your email with third-parties. Opt-out anytime.