Learn

What are the Different Asset Classes

Video Transcript

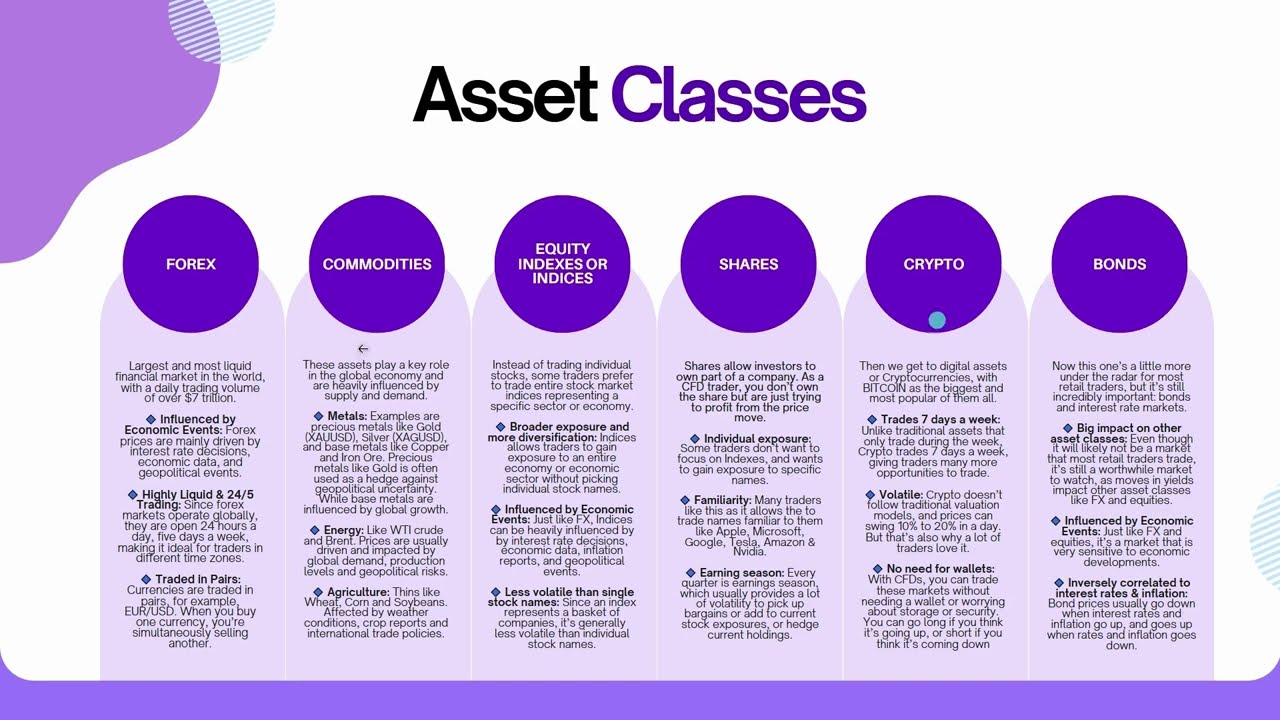

So, to summarize, FX is often considered as a favourite among retail traders because it can be very sensitive to economic events which provides ample amount of trading opportunities. The major currencies pairs usually have very high liquidity and trades 24/5. They are usually traded in pairs, meaning you get to express a directional view of one currency against another.

Let’s move on to the next asset class, which is commodities. Commodities are some of the oldest assets traded in the world—physical goods like gold, oil, or even coffee. And even though most of us won’t ever take delivery of a barrel of oil, we can still trade its price.

There are three main types:

Precious metals like gold and silver, with gold being a favourite haven play when geopolitical risks start ramping up. Apart from precious metals, there is also base metals which assets like copper, which tends to be heavily influenced by global growth expectations.

Energy is the next big one with assets like crude oil and natural gas, which move based on global demand, OPEC decisions, and weather;

And, finally, we have agriculture with assets like corn or wheat, which are influenced by harvests, weather, and supply and demand.

Generally speaking, commodities are heavily driven by supply and demand. If something becomes scarce or demand suddenly spikes, prices for the relevant commodities can move fast. This is also one of the key characteristics of commodities that many traders like, which is the increased volatility, which is perfect for short-term traders looking for big moves.

The next asset class we’ll discuss is Equity Indexes or Indices. Apart from FX and commodities, major Indices is another favorite for traders. For most retail traders, trading individual stocks is a bit overwhelming because there are just so many to choose from. That’s where Indices come in, because instead of trading one individual company, you get to trade a whole basket of companies piled together. Indices are baskets of top-performing companies representing a specific country of economic sector. For example, the S&P500 tracks the 500 biggest companies in the United States. The NASDAQ 100 focuses more on Technology and tracks the 100 biggest ones in the US. If you don’t want to trade the US, you can always swap for trading Germany’s DAX or the UK’s FTSE100. This can even be broken down into equity sectors as well with a few ETF products allowing traders to trade specific economic sectors like Technology, Energy, Health Care, Utilities etc. One of the benefits of Indices is that they tend to trade more stable than individual stocks, but they still move a lot and are volatile enough for day and swing traders. Just like FX, Indexes are also very reactive to economic risk events, so they provide ample amount of tradable volatility.

The next asset class on the list is Share CFDs. When most people think about the markets, this is probably what comes to mind most, the idea of buying shares of big-name companies like Apple, Microsoft, Google, Tesla or Amazon. For investors who buy actual company shares, the idea is to own a small piece of ownership in a company. Maybe because an investor believes in the product, or they want long-term growth or the are interested in dividends, or really like the company’s management. As a CFD trader, you’re not really worried about all of that, as you won’t be owning shares in the company, you are only interested to profit from the price moves. Whether you think the stock price will go down or go up, you can trade it both ways with CFDs. Stock prices move on all sorts of stuff—earnings reports, new product launches, changes in leadership, or even global economic news. But out of most drivers, quarterly earnings season when companies report results usually creates a lot of volatility for traders to take advantage of. This is especially true for the BIG 7 Technology stocks Google, Microsoft, Apple, Amazon, Meta, Tesla and Nvidia, who together make up close to 60% of the market cap of the NASDAQ100. This means watching these names around their earnings releases are important for share traders, as well as Index traders as a big surprise move in any one of these names can impact the NAS100 and US500 as well.

The next asset class is one that probably needs to introduction, and that is Cryptocurrencies. The most popular of course is BITCOIN, but the list of cryptocurrencies has grown substantially over the past few years. There are many things that traders like about Crypto, and from a trader’s point of view, the fact that they trade 7 days a week is one of the biggest magnets to this asset class. This means traders can trade this any day of the week, even over weekends when other traditional markets are closed. The other massive magnet for Crypto trades is the insane amount of volatility in the asset class. It’s not strange for these assets to move double digits in a few hours. There’s also not a lot of assets that can say they’ve gone up almost 20K percent in a decade. Now, there is nothing wrong with investing in Crypto through crypto exchanges, but that involves having access to a wallet and worrying about storage and security. However, with CFD’s, you can trade these markets without needing to worry about any of that, because you won’t own the underlying coin, you are simply trading the price movement or expected price movement.

The last asset class we will quickly mention is Bonds. This one’s a little more under the radar for most retail traders, but it’s still incredibly important: bonds and interest rate markets There are very few places where retail traders can get access to trading bonds, but that doesn’t mean it’s an asset class to ignore. Even if you don’t trade bonds directly, you’ve got to watch them. They influence everything—from currencies to stocks. Rising yields can push up a currency like the dollar, while falling rates often boost equities. Understanding bond moves helps you understand the bigger picture. A great example of why bonds and bond yields matter can be quickly illustrated with this chart. Notice how closely correlated the EURUSD currency in black, is trading with bond yields in pink. This relationship is by no means isolated to the EURUSD but occurs time and time again across other asset classes as well. In other words, you don’t have to trade bonds to use them to your advantage.

Relevant Videos