Learn

What is a Pip?

Video Transcript

So, what exactly is a Pip?

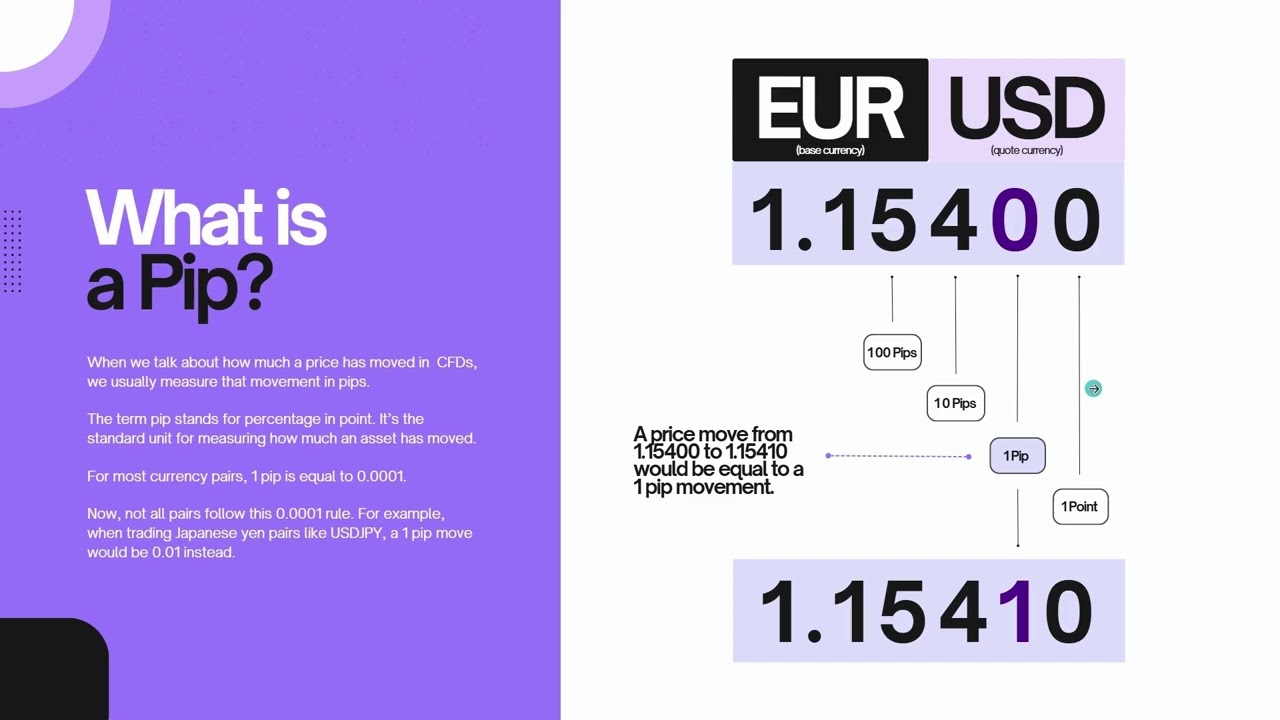

When we measure price movements in CFD trading, we use a unit of measurement called a pip. A pip stands for percentage in point, and it’s the standard unit of measuring how much an asset has moved up or down. Now, most currency pairs are quoted in 5 decimal places, like this currency rate we can see here for the EURUSD pair. For most pairs like this, a 1 pip move is equal to a move in the 4th decimal.

For example, if price was to move from 1.15400 to 1.15410, that would be equal to a 1-pip move. So, if we were to see a change in the 3rd decimal, that would be a 10-pip move, and a change in the 2nd decimal would be a 100-pip move and so forth. Now, this will differ slightly for JPY pairs and other asset classes as well. For example, you’ll notice on this chart, that JPY pairs don’t have 5 decimals, but are quoted in three decimals. And a 1-pip movement would be equal to a change in the 2nd decimal for JPY pairs. For example, if price was to move from 143.572 to 143.582, that would be equal to a 1-pip move in the pair. Now don’t be fooled, even though a 1-pip move might not sound like a big move, if you’re trading large positions, even a few pips can mean a lot of money. That brings us nicely to the importance of understanding your position size or lot sizes.

Relevant videos