A Beginner’s Guide to Trading Forex

Read Time: 13 Minutes

Embarking on your forex trading journey might seem daunting at first, but fret not! We’ve put together all the information you need to get started.

This guide is your friendly companion, packed with real-world examples, easy-to-grasp basics, newbie-friendly strategies, handy tips, and a step-by-step roadmap to kickstart your forex adventures.

Contents

Introduction to Forex Trading

How the Forex Market Works

Getting started in Forex Trading

Developing a Strategy

Practical Tips for Beginners

Resources for Further Learning

Introduction to Forex Trading

Foreign exchange trading, or forex trading, is the process of buying and selling currencies in the global financial markets. It is one of the largest and most liquid markets in the world, with an average daily trading volume estimated to exceed USD$7 trillion. Unlike traditional stock markets, forex trading operates 24 hours a day, five days a week, allowing traders to participate in the market at any time.

Understanding currency pairs

Forex trading involves the exchange of one currency for another at an agreed-upon price. This is done with the aim of profiting from fluctuations in exchange rates. Currencies are traded in pairs, where one currency is bought while the other is sold. The most commonly traded currency pairs, or ‘the majors’ as they’re more commonly referred to, include EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), AUD/USD (Australian Dollar/US Dollar), NZD/USD (New Zealand Dollar/US Dollar), USD/JPY (US Dollar/Japanese Yen), USD/CAD (US Dollar/Canadian Dollar), and USD/CHF (US Dollar/Swiss Franc).

Examples of other currency pairs, most often referred to as “crosses”, are AUD/JPY (Australian Dollar/Japanese Yen), GBP/NZD (British Pound/New Zealand Dollar), EUR/CAD (Euro/Canadian Dollar) and so forth.

And finally, less-traded currency pairs are referred to as “exotics”. Examples of these include USD/TRY (US Dollar/Turkish Lira), USD/HUF (US Dollar/Hungarian Forint). It’s important to note that exotic pairs tend to have wider spreads and higher volatility compared to major and minor pairs.

Uses of the forex market

The forex market is used by many players, for many different reasons. Retail traders aim at buying or selling a currency to take advantage of short-term fluctuations in price, whereas corporates who conduct regular international trade often use the forex market to hedge against their local currency weakening.

Large-scale players such as hedge funds or investment firms, will use the foreign exchange market to take advantage of divergences in interest rates between two nations in the form of a carry trade.

For more information on the types of forex trading, head to Part Four.

Reading Currency Pair Quotes

Currency pair quotes consist of two prices: the bid price and the ask price. The bid price represents the price at which you can sell the base currency, while the ask price represents the price at which you can buy the base currency. The difference between the bid and ask prices is known as the spread, which represents the broker's profit margin.

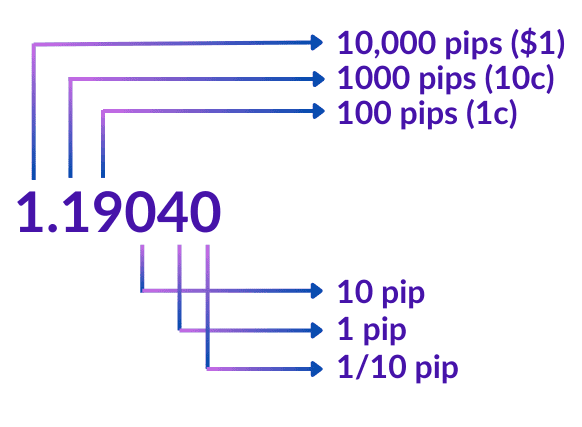

In forex trading, currency pairs are quoted in pips, short for "price interest point," representing the smallest possible price movement. For most major currency pairs, prices are quoted with four decimal points, indicating a change of 1/100 of one percent or 1 basis point. However, the Japanese Yen is an exception, trading with only two decimal points.

For instance, if the bid price for the EUR/USD pair is quoted as 1.19040, this breakdown refers to the five decimal places displayed on the market watch.

How the Forex Market Works

In order to trade the foreign exchange market effectively, you need to understand the nuts and bolts of how it works.

The forex market is decentralised, meaning that there is no central exchange where all transactions take place. Instead, trading occurs over-the-counter (OTC) through a global network of banks, financial institutions, and individual traders. Some of the larger players in the forex market are Deutsche Bank, UBS, Citi Bank, RBS and more.

Prices are determined by supply and demand dynamics, with exchange rates fluctuating based on economic indicators, geopolitical events, and market sentiment.

How the system works

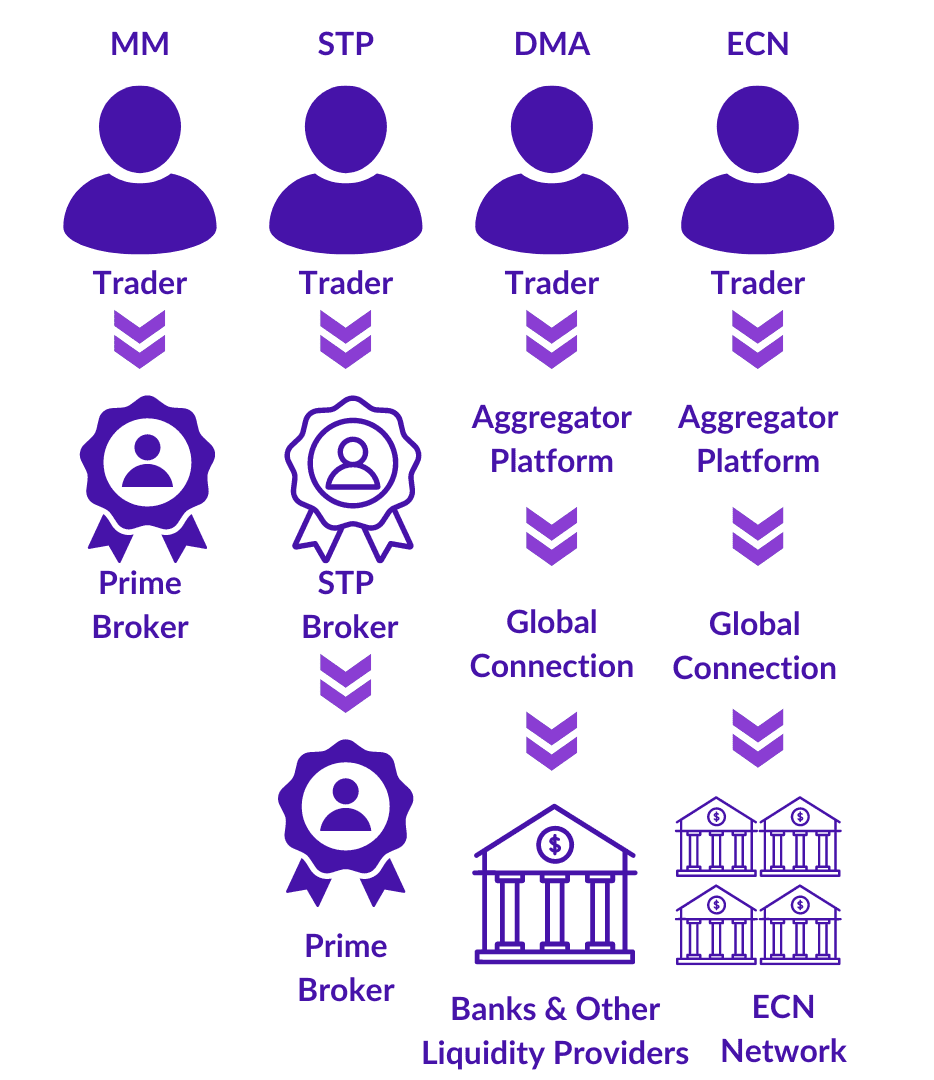

Market makers are key players in the forex world. They establish both the buying (bid) and selling (ask) prices, which are visible to everyone on their platforms. Their role extends to facilitating transactions with a diverse clientele, including banks and individual traders. By consistently quoting prices, they inject liquidity into the market. As counterparties, market makers engage in every trade, ensuring a seamless flow: when you sell, they buy, and vice versa.

Electronic Communications Networks (ECNs) play a crucial role in forex trading by aggregating prices from various market participants like banks, market makers, and fellow traders. They showcase the most competitive bid and ask quotes on their platforms, drawing from this pool of prices. While ECN brokers also act as counterparts in trades, they differ from market makers in their settlement approach rather than fixed pricing. Unlike fixed spreads, ECN spreads fluctuate based on market activity, sometimes even hitting zero during peak trading times, especially with highly liquid currency pairs like the majors.

Direct Market Access (DMA) empowers buy-side firms to directly access liquidity for securities they aim to buy or sell through electronic platforms offered by third-party providers. These firms, clients of sell-side entities like brokerages and banks, maintain control over trade execution while leveraging the infrastructure of sell-side firms, which may also function as market makers.

Straight Through Processing (STP) represents a significant leap in trading efficiency, transitioning from the traditional T+3 settlement to same-day settlement. One of its notable advantages is the reduction of settlement risk. By expediting transaction processing, STP enhances the likelihood of timely contract settlement. Its core objective is to streamline transaction processing by electronically transmitting information, eliminating redundant data entry and enabling simultaneous dissemination to multiple parties when necessary.

Getting Started in Forex Trading

Choosing a Broker

When selecting a forex broker, it's essential to not only consider the fees, but also regulatory compliance, trading platform, and customer support. Look for brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

Here at Fusion Markets we’re dedicated to offering a quality service with an affordable fee structure. You can learn more about trading forex or view our licences.

Setting Up Your Trading Account

Once you've chosen a broker, the next step is to open a trading account. This typically involves completing an online application, submitting identification documents, and funding your account. Forex brokers offer various account types to suit different trading preferences, including standard accounts, mini accounts, and demo accounts for practice trading.

Before risking real money, practice trading with a demo account to familiarise yourself with the trading platform and test your trading strategy in a simulated environment. Demo accounts allow you to gain valuable experience without the risk of financial loss. We also offer demo trading for those who want to test the water first.

Developing a Strategy

Identify Your Trading Style

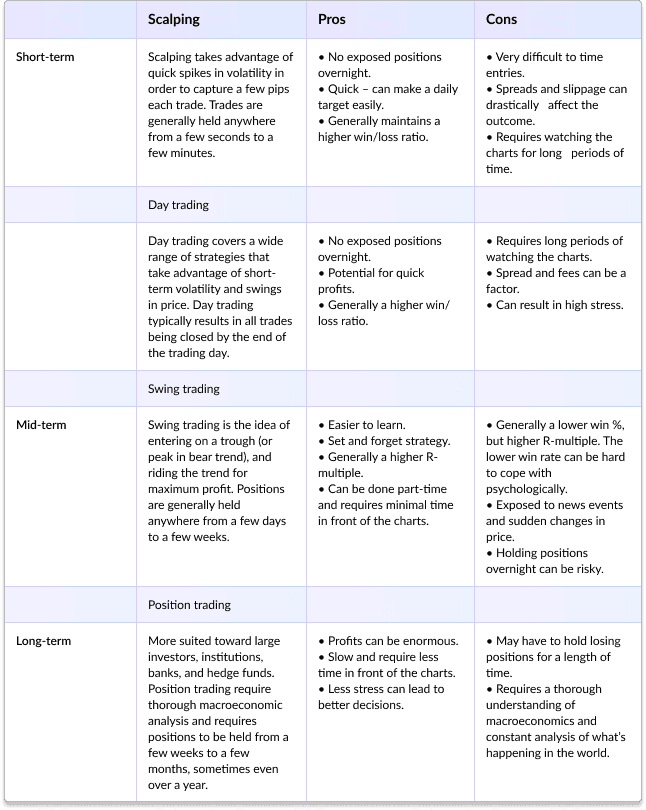

Before developing a trading strategy, it's essential to identify your trading style, whether it's day trading, swing trading, or position trading. Your trading style will dictate the timeframe you trade on and the types of setups you look for in the market.

Below are the types of pros and cons of each trading style:

Types of Analysis

Fundamental Analysis

Unlike technical analysis, which primarily relies on historical price data, fundamental analysis examines economic indicators, monetary policies, geopolitical events, and other macroeconomic factors to gauge the strength and direction of a currency's movement.

Central to fundamental analysis is the understanding that currency prices are ultimately driven by supply and demand dynamics, which in turn are influenced by broader economic conditions. For example, factors such as interest rates, inflation rates, GDP growth, unemployment levels, and trade balances can all impact a currency's value.

One of the key concepts in fundamental analysis is interest rate differentials. Central banks use interest rates as a tool to control inflation and stimulate economic growth. Currencies with higher interest rates tend to attract more investors seeking higher returns on their investments, leading to an appreciation in their value relative to currencies with lower interest rates. Traders closely monitor central bank announcements and economic reports to anticipate changes in interest rates and adjust their trading strategies accordingly.

Another important aspect of fundamental analysis is the assessment of economic indicators. These indicators provide insights into the health of an economy and can influence currency prices. For example, strong GDP growth and low unemployment rates are typically associated with a robust economy and may lead to appreciation in the currency. Conversely, high inflation or rising unemployment may weaken a currency.

Geopolitical events can also have a significant impact on currency prices. Political instability, conflicts, trade tensions, and other geopolitical factors can create uncertainty in the market and cause fluctuations in currency prices. Traders must stay informed about geopolitical developments and assess their potential impact on currency markets.

While fundamental analysis provides valuable insights into the long-term trends and direction of currency markets, it is important to note that currency prices can also be influenced by short-term factors and market sentiment. Therefore, traders often use a combination of fundamental and technical analysis to make informed trading decisions.

Technical Analysis

Technical analysis involves studying historical price data and using various charting tools and indicators to identify patterns and trends. Common technical analysis tools include moving averages, trendlines, and oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). Traders use technical analysis to make short-term trading decisions based on price action and market momentum.

Technical analysis is a cornerstone of forex trading, offering traders a systematic approach to interpreting market dynamics and making informed trading decisions based on historical price movements and market statistics. Unlike fundamental analysis, which focuses on economic indicators and macroeconomic factors, technical analysis relies solely on price data and trading volume to forecast future price movements.

At its core, technical analysis is based on the efficient market hypothesis, which posits that all relevant information is already reflected in an asset's price. Therefore, by analysing past price movements, traders believe they can identify recurring patterns and trends that may indicate potential future price directions.

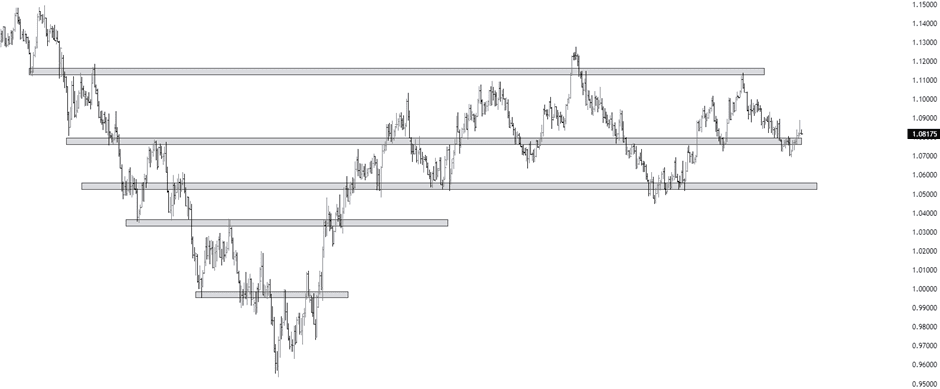

One of the fundamental concepts in technical analysis is that of support and resistance levels. Support represents a price level where buying interest is sufficiently strong to prevent the price from falling further, while resistance is a level where selling pressure is sufficient to halt an upward price movement. Traders use these levels to identify potential entry and exit points for their trades.

Example of support and resistance areas on EURUSD Daily chart

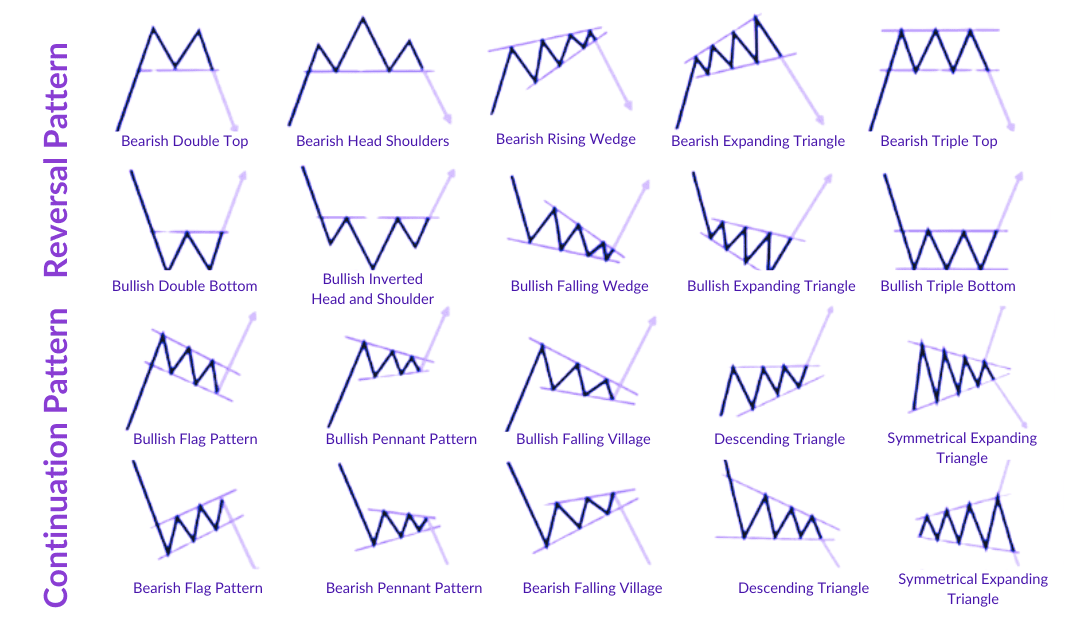

Another key tool in technical analysis is chart patterns, which are formed by the recurring movements of prices over time. Common chart patterns include triangles, flags, and head and shoulders formations. By recognising these patterns, traders attempt to predict future price movements and adjust their trading strategies accordingly.

In addition to chart patterns, technical analysts also utilise technical indicators to aid in their analysis. These indicators are mathematical calculations based on price and volume data and are used to identify trends, momentum, volatility, and other aspects of market behavior. Popular technical indicators include moving averages, oscillators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), and trend-following indicators such as the Average Directional Index (ADX).

While technical analysis is a powerful tool for forex traders, it is not without its limitations. Critics argue that technical analysis is subjective and prone to interpretation bias, as different analysts may draw different conclusions from the same set of data. Moreover, technical analysis does not account for fundamental factors such as economic news and geopolitical events, which can have a significant impact on currency prices.

Despite these limitations, technical analysis remains an indispensable tool for forex traders worldwide. By understanding and applying technical analysis principles, traders can gain valuable insights into market trends and dynamics, allowing them to make more informed trading decisions and improve their overall trading performance.

Risk Management

Setting Stop-Loss and Take-Profit Orders

Stop-loss orders are used to limit losses by automatically closing a trade at a predetermined price level. Take-profit orders, on the other hand, are used to lock in profits by closing a trade when the price reaches a specified target. By using stop-loss and take-profit orders, traders can manage risk and control their downside exposure.

Position Sizing

Position sizing involves determining the appropriate amount of capital to risk on each trade based on factors such as account size, risk tolerance, and the probability of success. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade to preserve capital and avoid significant drawdowns.

Your Strategy

Once you’ve determine what style of trading would suit you best, you now need to develop a strategy. There are thousands of different strategies out there so you have the choice of learning one from someone else, or developing your own.

Regardless, some common strategies include:

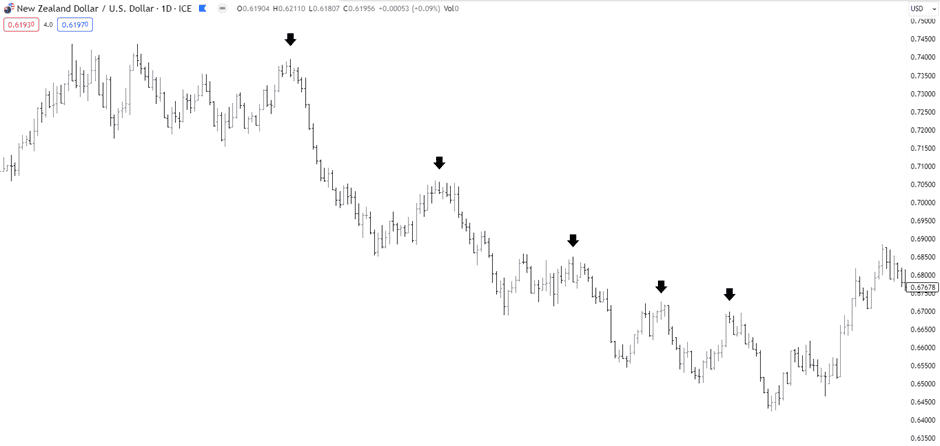

Trend Following Strategies

Trend following strategies in forex trading involve identifying and capitalising on established market trends. Traders employing this approach aim to enter positions in the direction of the prevailing trend, whether it's upward (bullish) or downward (bearish), and ride the momentum for as long as possible. These strategies typically utilise technical indicators, such as moving averages and trendlines, to confirm the direction of the trend and determine optimal entry and exit points. The goal of trend following strategies is to capture significant portions of a trend's movement while minimising losses during market reversals.

NZDUSD Daily Chart showing optimal entry points to go short during a bearish trend.

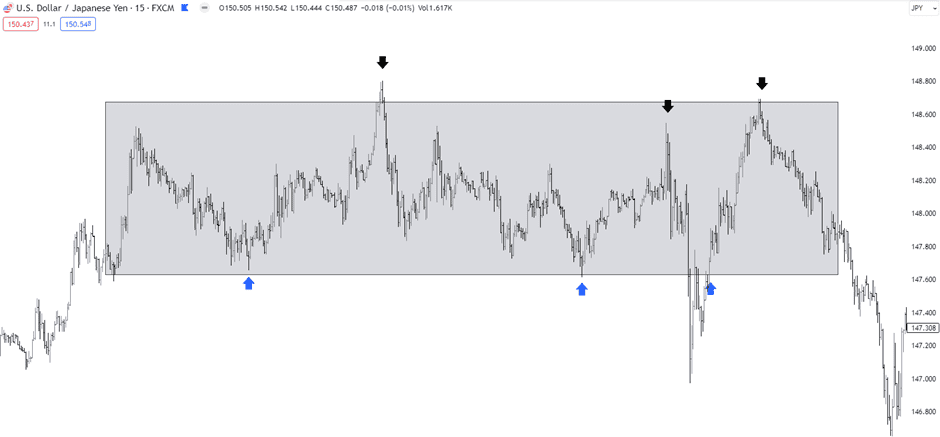

Range-bound strategies

Range-bound strategies in forex trading focus on exploiting price movements within defined ranges or boundaries. Traders employing this approach identify periods when a currency pair is trading within a relatively narrow price range, bounded by support and resistance levels. Instead of following a trend, range-bound traders seek to buy near support and sell near resistance, aiming to profit from the price being restricted to the range highs and lows.

USDJPY 15min chart with optimal buy and sell signals for a range-bound strategy

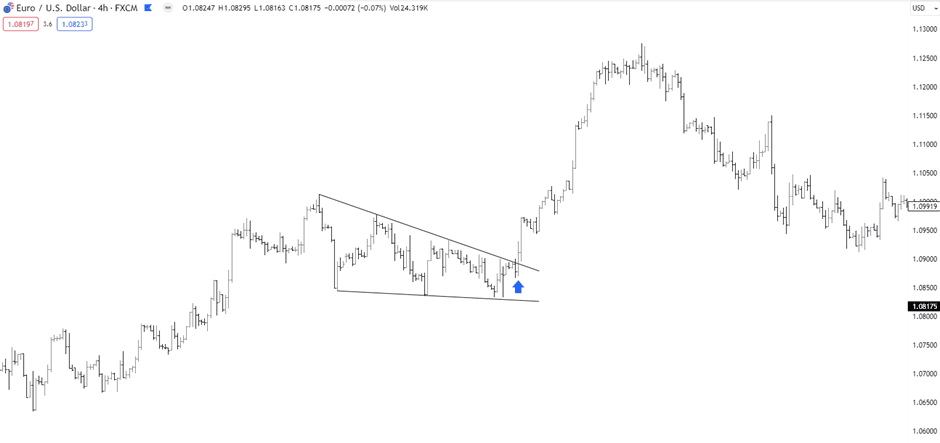

Breakout Strategies

Breakout trading strategies in forex involve capitalising on significant price movements that occur when an asset's price breaks through predefined support or resistance levels. Traders employing this approach wait for a clear breakout from the established range and then enter positions in the direction of the breakout, anticipating continued momentum in that direction. Breakout traders typically use technical indicators, such as trendlines, moving averages, and volatility measures, to identify potential breakout opportunities and confirm the strength of the breakout. The goal of breakout trading strategies is to capture rapid price movements and profit from the subsequent price trend.

Example of an opportune entry for a bullish breakout trade on EURUSD 4-hour chart

The key to developing a strategy that works for you is by studying the charts and thinking about what makes sense to you. If you think patterns make sense as they identify areas of consolidation which can lead to a breakout, then pattern trading could be a good fit for you.

It’s important for any trader to stick with their chosen strategy and not switch strategies every time they encounter a losing streak.

Practical Tips for Beginners

Maintain a Trading Journal

Keeping a trading journal allows traders to track their performance, analyse their trades, and identify areas for improvement. A trading journal should include details such as entry and exit points, trade rationale, risk-reward ratio, and emotional state. By reviewing past trades, traders can learn from their mistakes and refine their trading strategies over time.

Avoid Overleveraging

While leverage can amplify profits, it also increases the risk of significant losses. Avoid overleveraging by using leverage cautiously and only trading with capital you can afford to lose. A general rule is to keep leverage levels below 10:1 to mitigate risk effectively. The best position is cash. You should ensure you’re only taking the most high-probability set-ups that are in-line with your strategy.

Stay Disciplined

Maintain discipline in your trading approach by sticking to your trading plan and avoiding emotional decision-making. Avoid chasing losses or deviating from your strategy based on fear or greed. Consistency and discipline are key to long-term success in forex trading. Sometimes it’s best to walk away from the charts and come back the next day with a clearer head.

Manage Emotions Effectively

Trading can be emotionally challenging, with the potential for both euphoria and despair. Learn to manage your emotions effectively by practicing mindfulness techniques, maintaining a positive mindset, and taking regular breaks from the market. Remember that losses are a natural part of trading, and it's essential to stay resilient and focused on your long-term goals.

We highly recommend reading our article on the Top 10 Hidden Biases here.

Be realistic with your expectations

Trading can be very lucrative, but it can also be very costly. Traders should be realistic in their expectations – what % will you aim for each month? How much are you going to risk? Risking 20% of your equity per trade will be great on winning trades, but it won’t take long for you to eradicate your entire balance on a handful of losses. Whereas risking 1% equity per trade will allow you to conserve as much capital as possible, whilst still gaining 1%+ per winning trade.

Resources for Further Learning

To continue your forex trading education, consider exploring the following resources:

- Books: "Currency Trading for Dummies" by Brian Dolan, "Japanese Candlestick Charting Techniques" by Steve Nison, and "Market Wizards" by Jack D. Schwager.

- Online Courses: Investopedia Academy, Udemy, and Coursera offer a variety of forex trading courses for beginners and advanced traders.

- Forums and Communities: Join online forums and communities such as Forex Factory, BabyPips and TradingView to connect with other traders, share ideas, and learn from experienced professionals.

Ready to get started?

Sign up for a free Demo account with us today.

We’ll never share your email with third-parties. Opt-out anytime.